So, one of the critical things consumers need to pay attention to is when a debt collector issues a 1099-C as a result of a debt settlement or a debt reduction. A 1099-C is reporting that the creditor provides to the IRS, and it can turn around and take money out of your taxes or require you to pay income on that forgiveness. - These are complex sets of tax rules and legal provisions that apply. The consumer needs to consult with a professional before they settle any debt to make sure that these rules don't come around and bite them in the end.

Award-winning PDF software

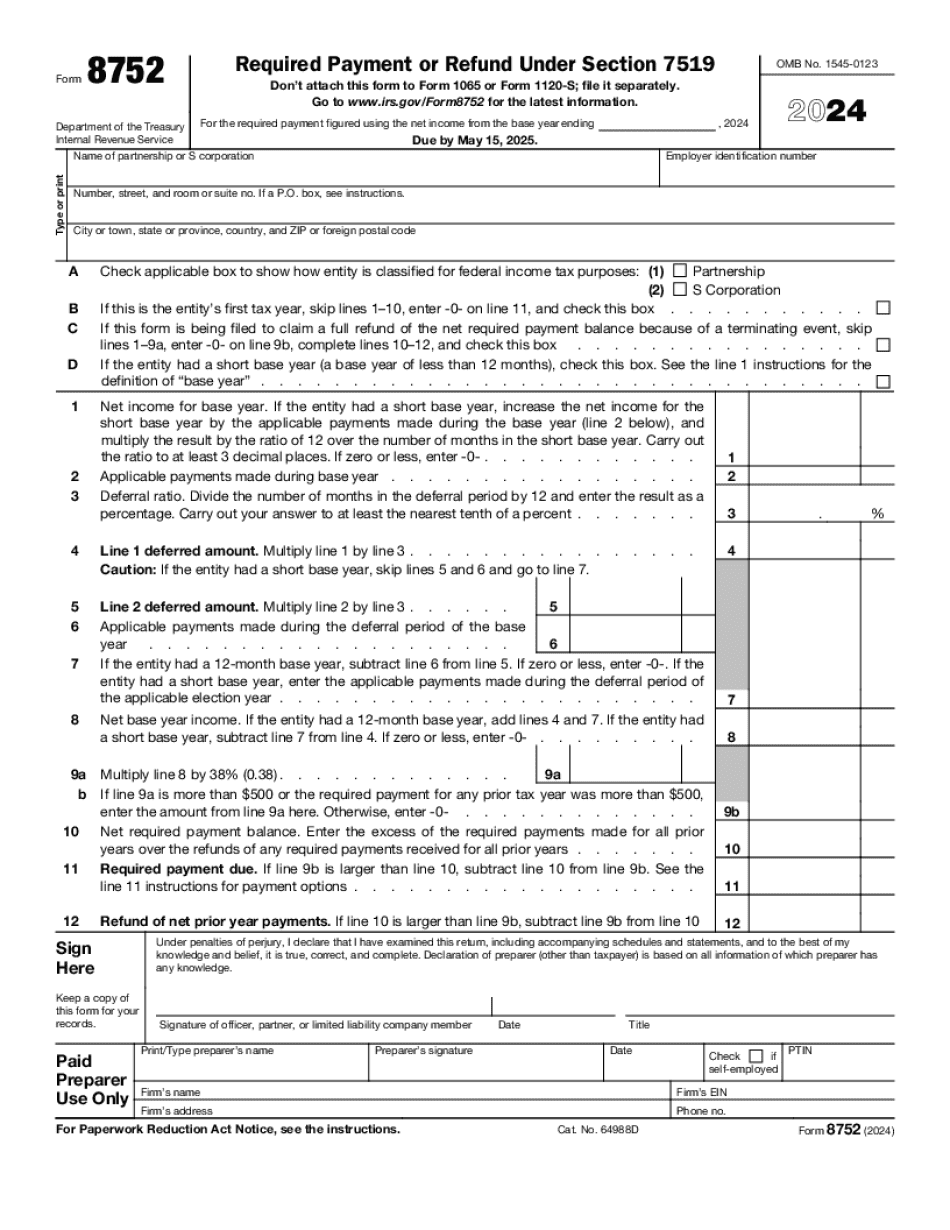

8752 Form: What You Should Know

You can download the forms from this website: What you need to do: Complete the Form 8752 with the Form 946 and a Statement of Exempt Organization or S Corporation Status for the last tax return year Schedule A—Forms and schedules for filing the Form 8, 946, and 971 and Form 8442 (see below) Schedule A—Forms and schedules for filing the Form 8, 946, and 971 and Form 8442 (see below) File with the IRS on or before the Due Date, usually 31st, of the Tax Due Month for the year in which you want to calculate the required payment or refund under section 7519. (The IRS may consider a payment under section 7464 (i.e., a payment to a trust established for your child's benefit) to be a payment under section 7519 for an earlier tax year.) If you don't do so and the tax year is more than 31 days from the due date, you may still be liable for the tax. Form 8472. Form 8472, Request for Withholding for Qualified Health Insurance Coverage, (CHIC), to report the amount of required payments under section 7501 and/or 7532. Form 8992, Request for a Taxpayer Identification Number (TIN), for reporting required payments under section 7521 and 7533. Form 946. See also Form 944 for a statement of your liability to pay tax on benefits under section 125 or 125A. Who is Reporting, and for when? The Form 8752 is not needed for reporting: Any amount that is reported for other income that would qualify under section 1372 or 6113 if received after the form 8752 was filed; Any amount reported for other income that would qualify under section 1371, 1372 or 6113 (if received in a separate return) if you received a separate Form 8752 ; or Any amount that would be included on Form 941(D)(1), or If you are a partnership, you must report only your income in order for the partnership to receive a deduction. The amount of required payment under section 7519 is the total net payments or refunds (if any) that must be reported on Schedule A or Form 946 if your partnership received a Form 8752. Who is not reporting, and for when? Neither your partnership nor your individual partners need to file Form 8752.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8752, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8752 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8752 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8752 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8752