Critical to understand when you're negotiating debt with any creditors is to understand the tax consequences. Oftentimes, if you settle the debt with a creditor, regardless of your financial status, you can be hit with a 1099-c. - Now, one of the ways to avoid the very negative consequences of a 1099-c is to prove your insolvency. However, it's a complex process that involves many factors in a constantly changing set of laws. - It is critical that consumers talk with a professional before settling the debt. - Additionally, it is crucial to deal with a tax professional after settling the debt to handle any potential tax implications.

Award-winning PDF software

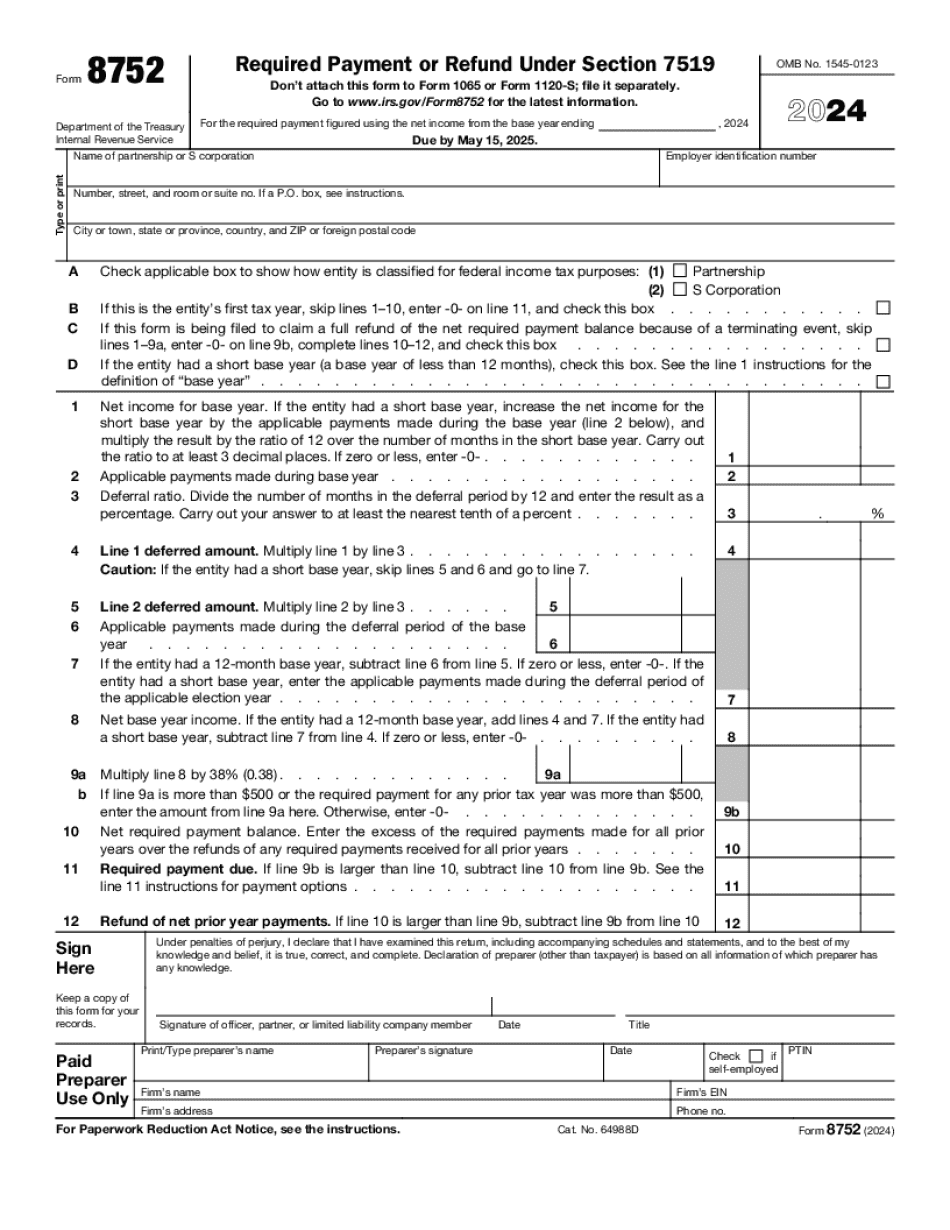

8752 instructions 2025 Form: What You Should Know

Jan 21, 2025 — Form 8758, Voluntarily Disclosing Information on Foreign Tax Returns (or U.S. Tax Returns) Under Section 7468, or Filing and Reporting in Multiple Tax Years for Certain Taxpayers (or Filing and Reporting in Multiple Tax Years for Certain U.S. Taxpayers) Form 8758. Author / Creator: United States. Reproducible copies of federal tax forms and instructions. Note: For applicable election years beginning in 2016, Form 8758 must be filed and the required payment made on or before. May 15, 2017. △! CAUTION. For your base 2013, 2014, 2015, 2016, 2025 and 2018, Forms. 8758 must be filed and the required payment made on or before. May 7, 2018. △! CAUTION. For your base 2015, 2016, 2017, 2018, 2019, 2019, 2025 and 2020, Forms. 8758 must be filed and the required payment made on or before. May 15, 2018. Taxpayer Identification Number (TIN). The taxpayer identification number (TIN) or Social Security number, as required by Section 6127(b) of the Internal Revenue Code, must be shown on the face of each return or statement that is required to be filed or made by the taxpayer subject to any requirement of this chapter and each item of information provided in connection with the filing of the return, statement or information. The taxpayer identification number or Social Security number, (or any combination of them) may appear on any form or invoice that the taxpayer is required to file with the IRS and on any other form or invoice that is required by, or furnished by, any third party provider for purposes of collecting a fee from the taxpayer, except other information provided by the taxpayer to the third party provider, if provided when the third party provider receives the information. If the taxpayer furnishes the information to the third party provider on or before the last day of the first tax year in which the information is to be furnished, the third party provider must use the information to furnish the information to the IRS on or before the last day of the same tax year. Note: If Form 8758 is required to be filed within one year of the end of an election year, the election year is the year beginning with the month in which Form 8758 is due. Otherwise, the election year is the tax year that includes the last day of the last tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8752, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8752 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8752 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8752 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8752 Instructions 2025