So, consumers need to understand that their debts can haunt their family even after their death. Creditors that issue a 1099-C, and any other kind of creditor, may make claims in an estate that can prevent your heirs from taking advantage of probate rules and laws. A critical thing to understand is that consumers need the advice of experienced professionals anytime they're dealing with debt collectors, and especially probate, in the state attorney's office when they're dealing with a debt collection after death.

Award-winning PDF software

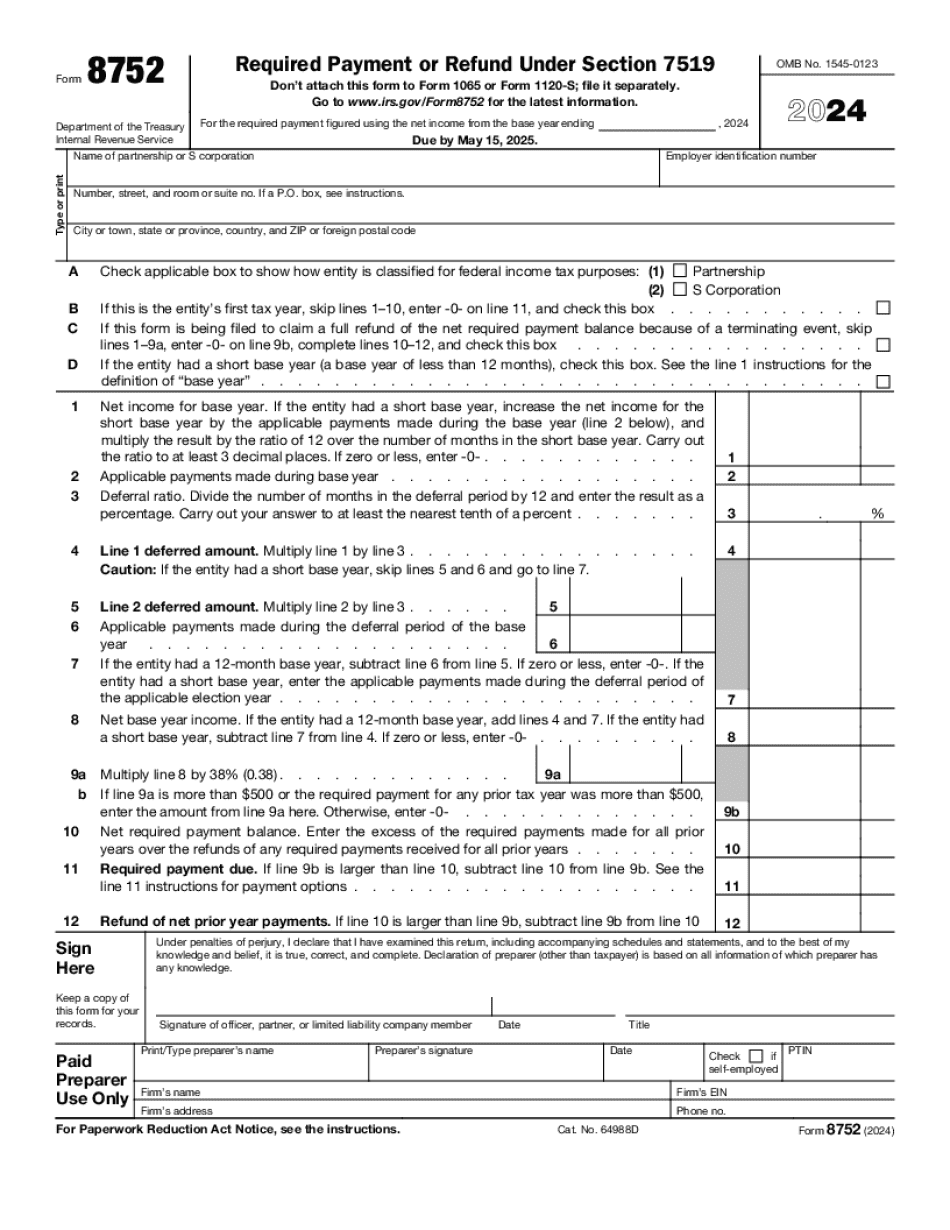

8752 help Form: What You Should Know

In other words, the entity still generally is obligated to file Form 8752 when it makes a donation during 2016. Required Payment or Refund Under Section 7519 The Form 8752 is required under section 7519 for the following reasons: Under section 7519, you are required not to charge your campaign for amounts on which you received a net advance from your campaign for the prior year(s) in an amount that exceeds the contribution limit for that election. Under section 7519, if your campaign had contributions collected in other election years totaling 1,000 and collected contributions in 2025 totaling 500, the election contribution limit for 2025 would be 700,000 (or 500,000 for an election year after 2019), provided your total contributions in your election year (or any 2 following election years) are 500,000 or more. When is the deadline to file Form 8752, and why is the deadline only for the election year? According to current guidance for the election year, the filing deadline for 2025 election year is April 30, 2017. Your election year begins on January 1 of such year. If you do not file the Form 8752 by April 30th, 2017, you will incur a penalty. May 18, 2025 — Updated guidance that clarified what the statute of limitations for 2025 election years is for individuals donating to candidates for the Office of the President and Congress. What are the required forms and instructions and examples for Form 8752? Form 8752 is a 590-page-long report. The report is filed with your tax return and filed electronically. Filing the report and completing the form are a lot of work and should be part of your regular tax preparation schedule. Please read over the sections below to be sure you are in the right place. Section 6 — Definitions You Need What is a Form 8752, Required Payment or Refund Under __________? Form 8758, Form 8759, Form 8660, Form 8660-B, Form 8665, and Form 941 — Contributions to Federal Candidates What is a Form 8750, Required Payment or Refund Under __________? Form 8751, Required Payment or Refund Under Section 4051(e) — Individuals Forms 8750, 8751, 8752 (see description for each).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8752, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8752 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8752 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8752 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8752 help