May it please the court, Julie Rodriguez of Green Burchard here on behalf of the appellant. We are here challenging a mandatory injunction against the joining rebuttal time. I'm going to reserve five minutes. The thing is, for the remainder, we are here challenging a mandatory injunction that requires the trustee, US Bank National Association, to disperse funds from an account that has been set up pursuant to a master trust indenture. Now, bear with me one moment, please. Isn't this essentially an automatic process that once the draws are approved by the district engineer, boom, they have to be paid? Absent a default, sure. Absent what said the fault, sure? I would agree with you if you looked control the situation because 4.3 speaks to when everything is fine, you go ahead and you get a request from the district for a construction draw request, then you pay it up. That's it. It's approved by the engineer and you don't have to question that. But what we have here, we can't do simply look at that provision in isolation. We have a host of sections that come into play. So, looking specifically to sections 6, Article 6, and Article 8, what we see is that we have certain powers and duties as the trustee that we have to enforce, primarily to the bondholders. Now, this gets interesting, of course, because we have a new bondholder in place, which has told us to go out everything. We still have a prior bondholder that the post position from the beginning was, "No, there's just a default. You cannot continue to pay." Now, the problem ensues because they are looking strictly at 4.3, as the trial court did. From our perspective, understand, we come into the situation pursuant to chapter 190 under...

Award-winning PDF software

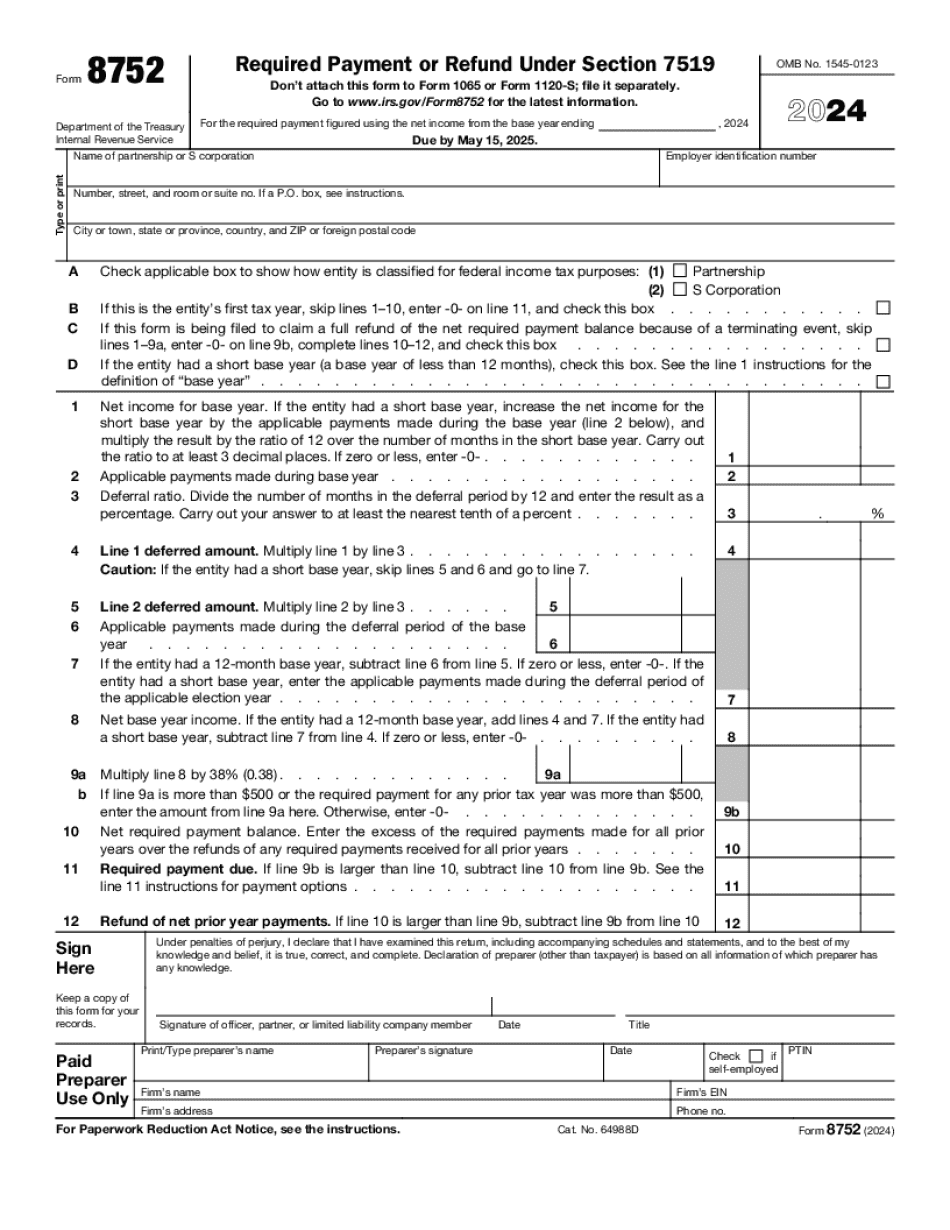

Where to send 8752 Form: What You Should Know

DC. Please note all engineers must use an electronic filing system (e-File) to file the Form 8752. The following is an excerpt from IRS Publication 463, page 1071. “A taxpayer may include comments on Form 8752 in writing to the Internal Revenue Service. After you mail the Form 8752, the IRS may send you a written reply asking you to file Form 8752 in a timely manner. In either case, you are required to respond to whatever response is sent you in a timely fashion.” The Form 8752 may be sent to the following addresses: Internal Revenue Service Office of the Chief Counsel Central Revenue Division 550 Pennsylvania Avenue NW Washington, DC. 20220 The IRS reserves the right to reject a Form 8752 that is completely incomplete. The Form 8752 may be mailed to: Internal Revenue Service Office of the Chief Counsel Central Revenue Division 550 Pennsylvania Avenue NW Washington, DC. 20220 Taxpayers can check the status of their Form 8752 by going to the “Form 8752” entry in the search and look for that entry and see if it hasn't been issued yet. What happens if I have questions or issues? If you need additional assistance, please contact: Internal Revenue Service Office of the Chief Counsel Central Revenue Division 550 Pennsylvania Avenue NW Washington, DC. 20220 For additional information, refer to Internal Revenue Code Section 6721. IRS Annual Audit Guide.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8752, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8752 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8752 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8752 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where to send Form 8752