Versus Vanessa Cuervos, Mr. Geddes, would you like to save some time for rebuttal? Yes, Your Honor, two minutes please. Good morning, may it please the court. Edward Getus on behalf of the appellant, Publix Supermarkets Inc. With the court's permission and unless the court has specific questions relating to the issue of the transcript, that's exactly the specific question which I have. How do we know this is a very interesting point of law that you have raised, but how do we know it made any difference to the result? It did, Your Honor, because, as well known, that Byron, I'm about to explain, Your Honor, but we did in fact submit the portion of the transcript where the trial court, right before trial began, made its ruling in lemonade, indicating that 768 755 would not apply, that the predecessor statute would apply. It was unequivocal, it was clear that at that point in time, the play. How do we know that that made any difference? Aren't we entitled to or and would not have won under either statute because, Your Honor, it's a fundamental mistake. Because what was established, what the trial court did, if I may explain, Your Honor, but the trial court did was completely alter the way Publix strategically tried the case. In other words, knowing that it was not, do we know that if they had tried the case anyway, they would have really won or lost? That's it. The only thing that this makes any difference on is the jury instruction, really. Because what, Your Honor, what do we know? Even know what the jury instruction was. The jury instruction was a standard instruction that did not include yet any reference to the statute. So then, what's the difference? The difference is, Your...

Award-winning PDF software

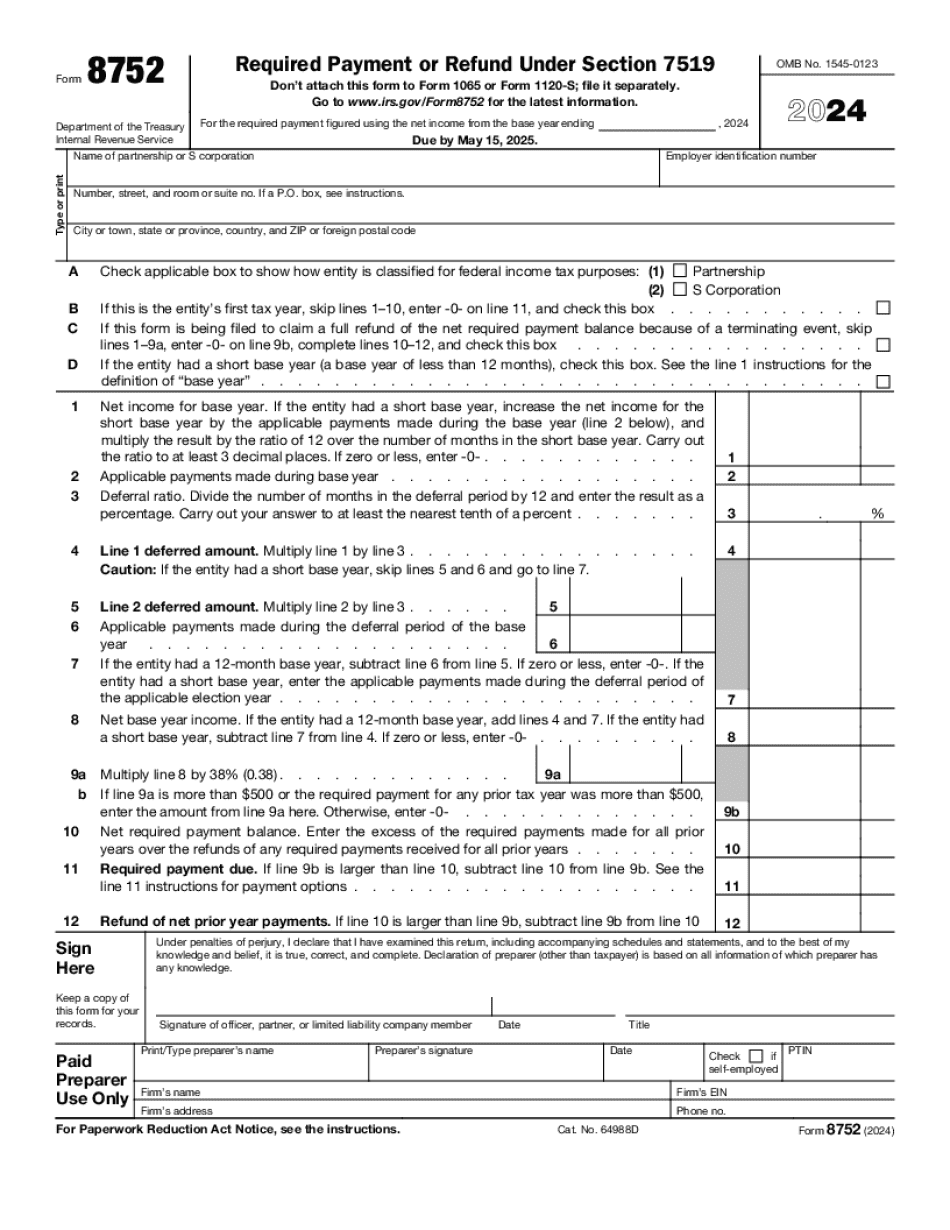

8752 instructions 2025 Form: What You Should Know

No reproduction of this form, part or information in any form unless a written permission is granted by the Chief Counsel, Internal Revenue Service, 100 F Street, NW, Washington, DC. February 10, 2025 — Abstract: Partnerships and S corporations use Form 8752 to compute and report the payment required under Internal Revenue Code section 7519 or Form 8752, required payment or refund under section 7519 Sep 8, 2025 — Abstract: Form 8752 and Section 7519 are treated as a single document, even though they are treated differently by the Internal Revenue Service. If you have a Form 1065 from a partner or S corporation, it will be treated as if it contained the provisions of section 8752 and the requirements for filing Form 8752. Sep 8, 2025 — Abstract: Section 7519 does not apply to you if the partner or S corporation pays or refunded the tax on or before the due date of their return. May 2, 2025 — Abstract: Any partnership or S corporation that makes the election to have a tax year other than the general instructions specific instructions of Form 8752 May 2, 2025 — Abstract: The following forms are used to determine whether you are a partner, an S corporation or an individual. Notice 828 to which the partnership or S corporation makes the election to have a tax year other than the general instructions specific instructions of Form 8752 (or section 6034(a) of the Internal Revenue Code), and which is incorporated in its own right by reference (see “The Notice and Notice of Withholding by Partnerships and S Corporations”) contains information about the filing of Form 8752 and Section 7519. Form 8758 and Schedule L, Statement of Changes in Ownership (Section 6034(a) of the Internal Revenue Code), and Section 6322(e) of the Internal Revenue Code (see “Section 6322(e) of the Internal Revenue Code” for information about the filing of Form 8758 and Schedule L), all of which are incorporated within the notice, which lists the section 7036 provisions. Form 8562A and C, Statement of Business (Section 6034(a) of the Internal Revenue Code), and Section 6322(e) of the Internal Revenue Code (see “Section 6322(e) of the Internal Revenue Code” for information about the filing of Form 8562A and C, Form 4065).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8752, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8752 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8752 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8752 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 8752 instructions 2025