Award-winning PDF software

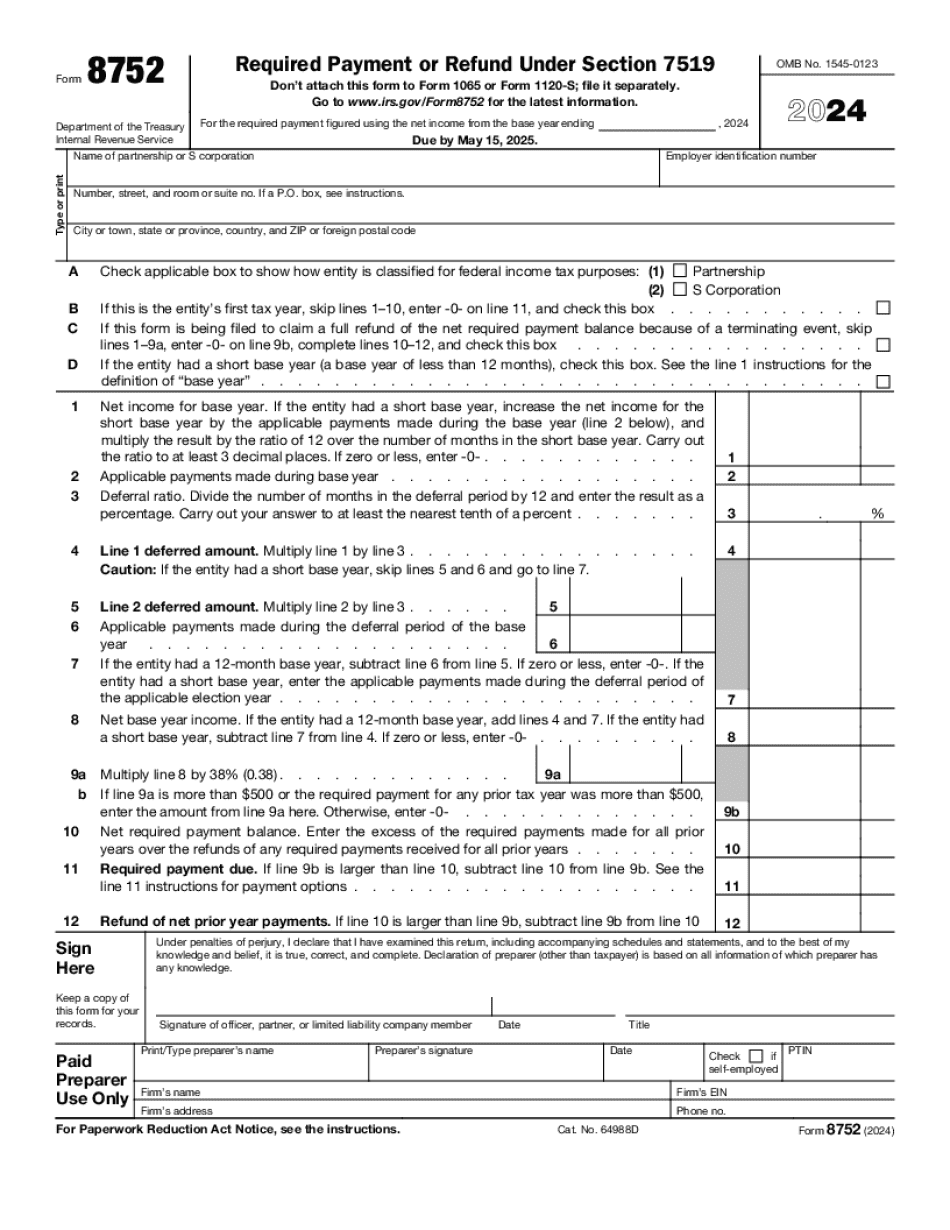

Cambridge Massachusetts online Form 8752: What You Should Know

Connecticut's income tax deductions, and have not already done so can do so by using these new options. Form CT-1040X can now be filed on paper or electronic. The online registration link is here. Connecticut Registered Estate, Gift, Generation-Skipping Transfer, or Generation-skipping Transfer Treated as a Gift; or Estate, Gift, or Generation-Skipping Transfer of a Creditable Estate Connecticut Statute July 5, 2025 — This law affects the treatment of certain life events. See CT Statute section 60-201 of the Financial Institutions Law. The Connecticut Income Tax and Capital Gains Tax Law includes provisions to address the transition and changes to Connecticut's income taxes and capital gains tax. See CT Statute sec. 6-1E. Connecticut Income Taxes — For more information, see Connecticut Income Taxes. Form CT-2, Information for Establishing Establishments — for filing estate, gift, inherited, and inherited trust income tax returns. Form CT-5, Connecticut Estate or Gift Tax Return. Complete the paper form and send it to the Connecticut State Board of Tax Review. The electronic form is available here. Connecticut Resident Property Tax — CT.gov Aug 27, 2025 — The law has been revised to establish an annual reporting requirement for corporations and estates that will be effective January 1, 2019. See CT Statute sec. 6-3A1. Connecticut Tax Preparer Tax Guide — CT.gov Feb 24, 2025 — Connecticut's personal income tax, gross receipts tax, excise tax, and gift, estate, generation-skipping transfer, and estate tax return preparer taxes are all subject to the Connecticut Tax Preparer Tax Guide. This free online guide provides information you need to prepare your tax return for the Connecticut income tax, personal income tax, excise tax, and gift, estate and generation-skipping transfer taxes. Connecticut Estate and Gift Tax — Publication 573 May 5, 2025 — Publication 573 outlines many basic aspects of the Connecticut estate and gift taxes. Connecticut Tax Collector Tax Guide — CT.gov Dec 2025 — Publication 573, Connecticut Estate or Gift Tax and New Jersey Estate or Gift Tax, provides information on the Connecticut estate and gift tax and New Jersey estate or gift tax. Incentive Payments for Connecticut-Area Businesses; and Publication 577, Connecticut Business and Professional Registration Guide.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cambridge Massachusetts online Form 8752, keep away from glitches and furnish it inside a timely method:

How to complete a Cambridge Massachusetts online Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cambridge Massachusetts online Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cambridge Massachusetts online Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.