Award-winning PDF software

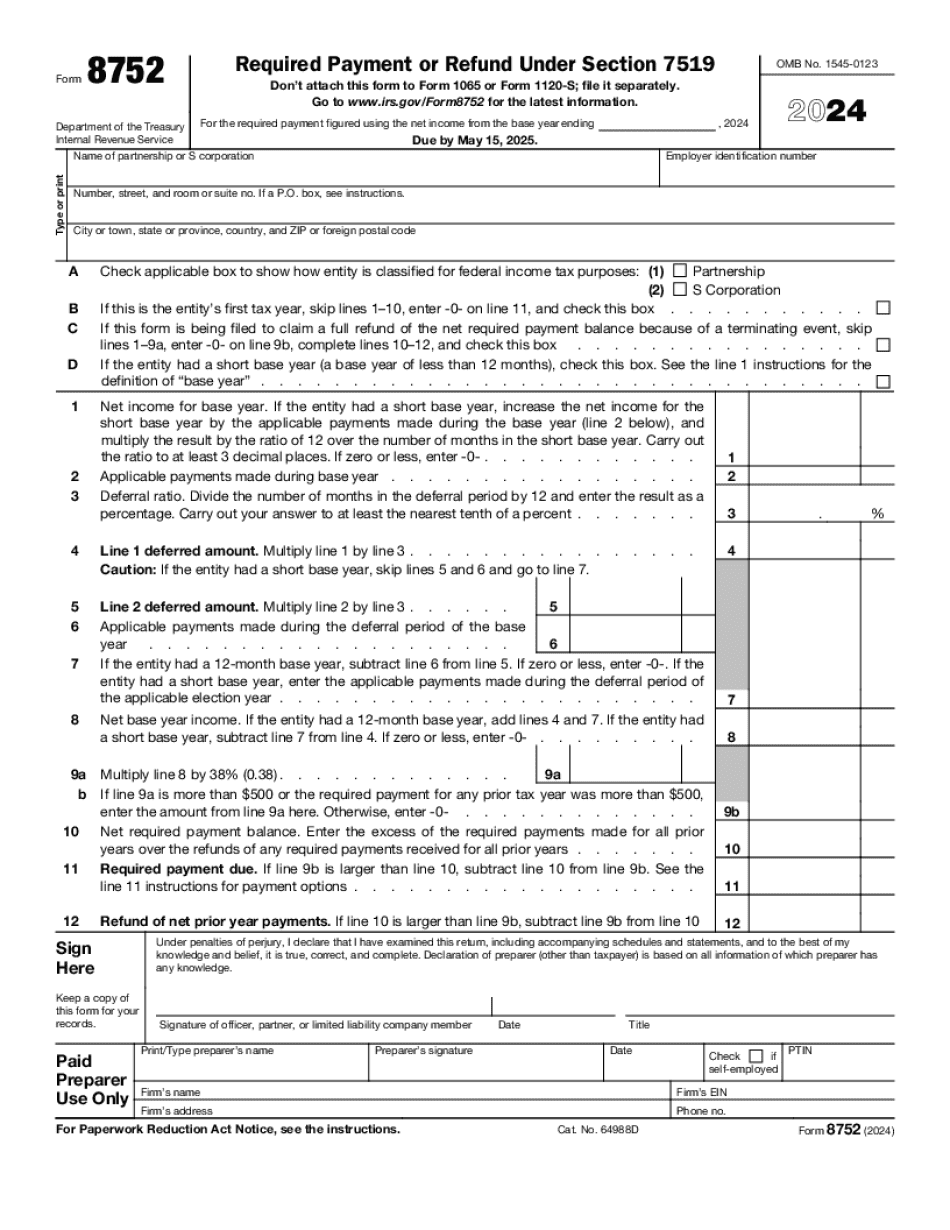

Cincinnati Ohio Form 8752: What You Should Know

This form is intended for use by the purchaser, instead of filing a separate U.S. Schedule K-1. Sales of business property are also considered taxable. Sale of Business Property on Form 4797 — Tax Guide for U.S. Taxpayers (PDF) In general, if your gain is within the exclusion rate of 25%, or for certain qualified sales of securities, 5%, or 10%, the gain is reported by use of Form 4797 by the seller. As explained below, only the purchaser (and, in turn, the seller's withholding agent and reporting agent) may report on a U.S. Schedule K-1 any gain on sales of business property. Generally, a taxpayer will receive a form 4797 to report this business property gain only if (1) certain conditions are satisfied, and (2) an information return is on file. If the taxpayer receives a form 4797, it is important that the information provided by the taxpayer is correct. Failure to provide the correct information may result in the taxpayer, or an agent acting for the taxpayer, being assessed a tax on such gain. Form 4797 — Sales of Business Property Sales of business property include items such as office furniture, fixtures, computers, software, furniture, hardware and equipment, books, records and documents. There are certain limitations on what types of gains from sales of business property are reported to the United States. Form 4797 — Sales of Business Property — General Requirements Qualified sales made solely for a tax-exempt purpose are reported on Form 4797 as shown below. Business entities do not have to report on Form 4797 the sale, exchange or other disposition of property solely for any tax-exempt purpose unless the property can be used to generate profits or losses for the taxable year or for more than one year. Gains from the sale of real property. Real property is any property used in the trade or business of a farming, ranching or horticultural occupation (unless the property is a farm). Property used by the owner as his or her residence may include a room, porch, and similar rooms. For additional information, see Special Rules for Qualified Real Property. Gain is deductible. No deductible gain is allowed on real property. The only type of gain allowed on real property is passive income. Note: A taxpayer can elect to use the special rules described in a section 1031(a)(1) election. See Special Rules for Qualified Sales of Real Property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cincinnati Ohio Form 8752, keep away from glitches and furnish it inside a timely method:

How to complete a Cincinnati Ohio Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cincinnati Ohio Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cincinnati Ohio Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.