Award-winning PDF software

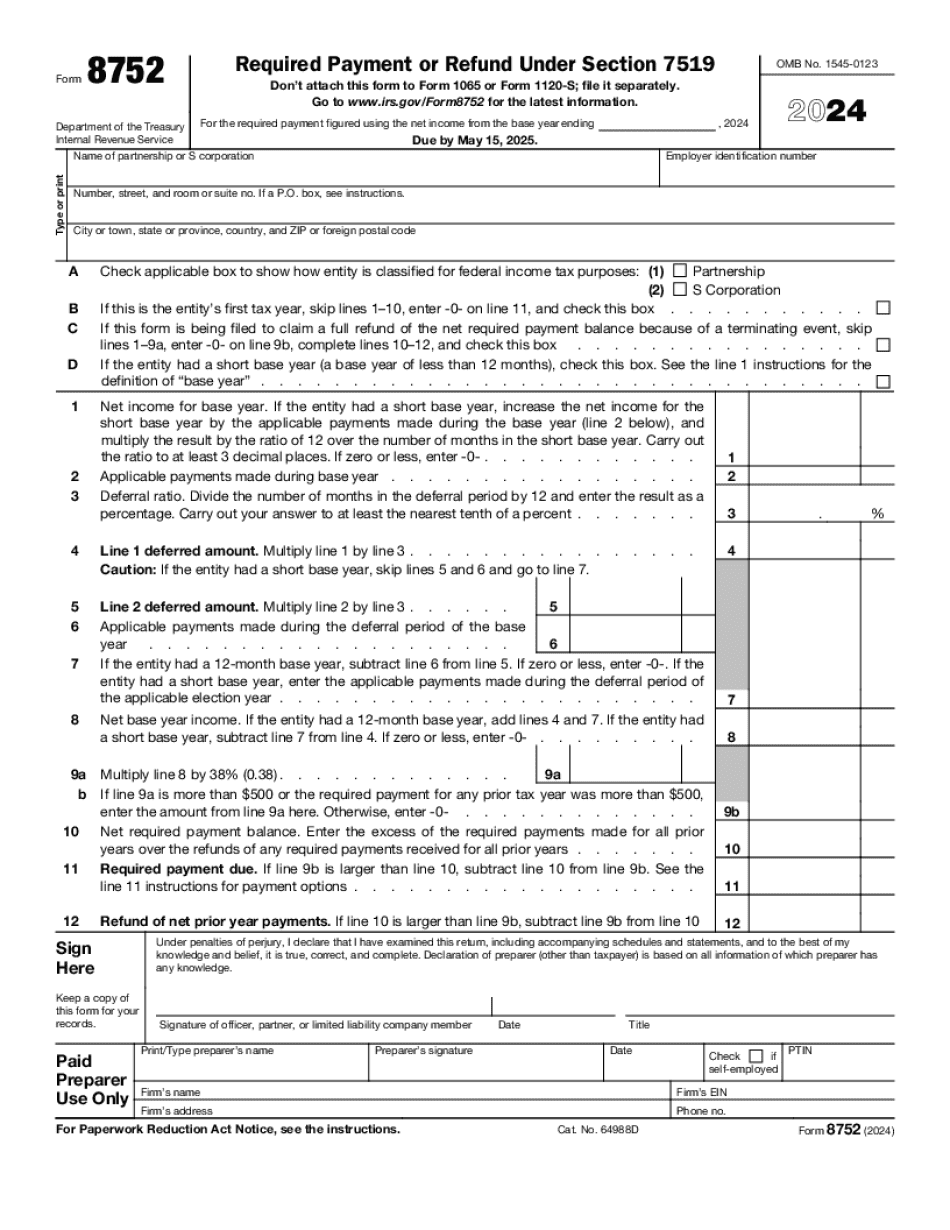

Form 8752 Corona California: What You Should Know

Required Payment or Refund (1105). Base year ending. Requirements for a section 444 Election To, which must be filed by the partnership or S corporation. This form applies to all section 444 electing partnerships or S corporations (excluding sole proprietorship) and all other Section 7551 qualifying partnerships or S corporations. (Form 8813, Election to), and all other qualifying entities, as defined by Sections 771 and 773, (Form 755, Form 8283, Qualifying Entity). For a complete description of section 444 elections, see Pub. 536, Qualified electing partnership and S corporation; Form 8813. Requirements for a section 7551 electing partnership (excluding sole proprietorship), or a qualifying entity, as defined by Section 771 and Section 773, (Form 8813). Requirements for a section 902 electing individual. Form 8751, Failure For Failure To Comply With Section 13(a)(1)(C). Show expandable text. Hide expandable text. A non-resident (nonresident alien) alien who fails to comply with the applicable income tax liability requirements is subject to penalties and interest under section 13(a)(1)(c) of the Internal Revenue Code. There is also an alternative penalty of six percent of the amount by which he or she exceeds the limitation. If the non-resident has already received an estimated statement, he may submit a new one instead of filing an amended return. If the failure results from a failure to file Form 8781, it will be due and payable on the 10th day after receiving the Form 8782 (or, if an estimate is received by the due date, on the due date). If he or she is subject to an assessment, the amount assessed will be due and payable no later than the date specified on the notice of assessment. If he or she is a foreign entity but files Form 8781 or was required to file Form 8782 with that notice of assessment, the amount assessed will not be due and payable under section 13(a)(15)(L) of the Internal Revenue Code, as amended on July 21, 2016. Section 522. Information For Individuals, Including Partnerships, S Corporations, Corporations Solely Owned By One Person, and Joint Venture Entities. The first section to discuss is Section 522.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 Corona California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 Corona California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 Corona California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 Corona California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.