Award-winning PDF software

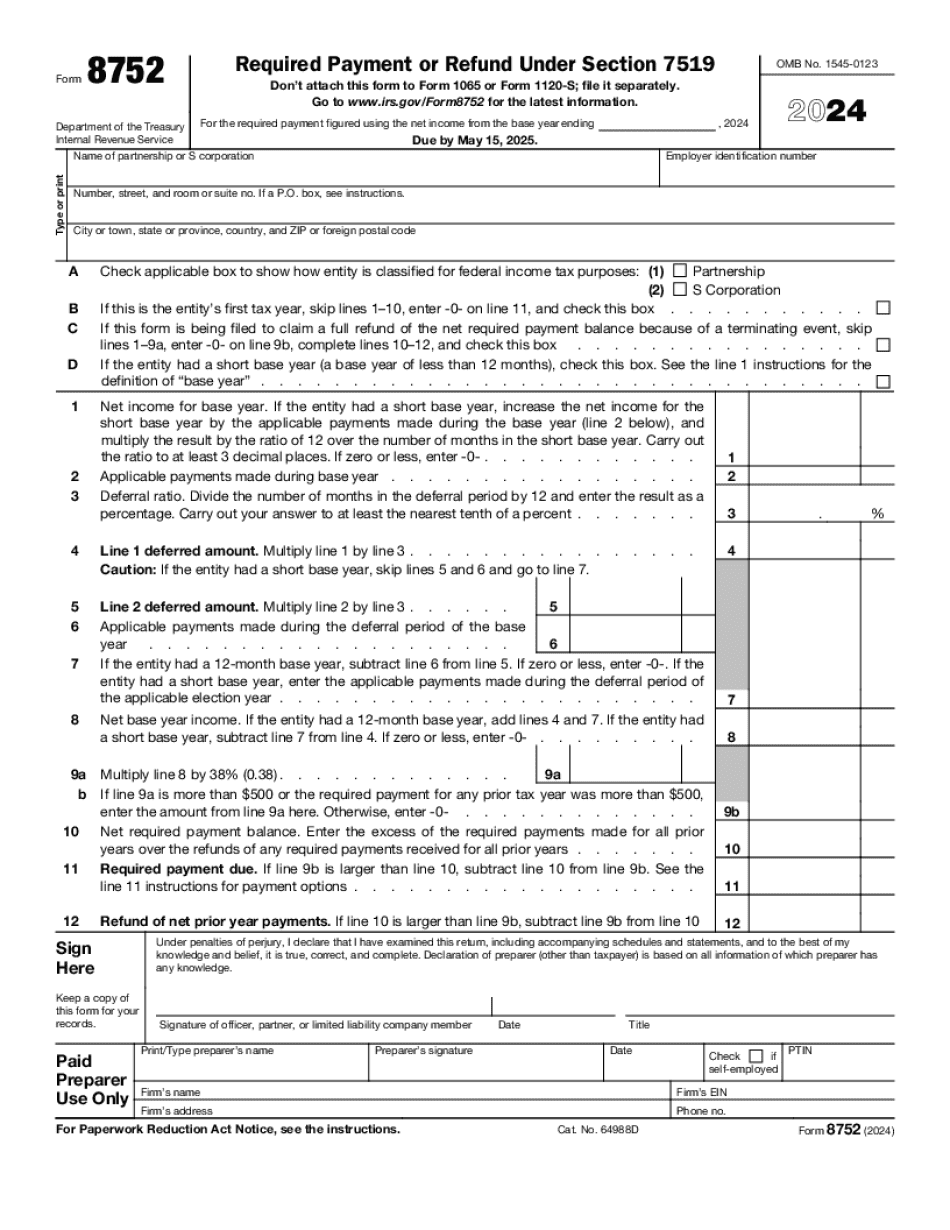

Form 8752 for Gilbert Arizona: What You Should Know

If you fail to file within the time required under current laws, the IRS sends a late notice to the Arizona Department of Revenue. The return is then due. After 2 months have passed, you would get a “Failure to File” notice. You will then have 15 business days to respond. If the IRS doesn't receive a response within that time frame, you get a Notice of Penalty and Fee. The fee is 1,400 for failure to file, and the notice can be used to recover back taxes from the Arizona Department of Revenue. The return is due again. If you don't show up with the appropriate information the 3 notices can escalate to a Collection Notice by the Arizona Department of Revenue. They can also add another penalty. That brings the total fee to 1,700 and the amount of taxes to be recovered to 8,400 (or 5,800 if the total amount is more than 22,500). I use Form 8752. Why should I use it? The Form 8752 is not just something to report out of desperation or guilt. It is an excellent filing tool and a wonderful way to report your sales tax to the Arizona Department of Revenue! In recent years, the Arizona Department of Revenue has made a huge effort to ensure that all Arizona taxpayers are tax compliant. For example, on July 1, 2016, the State launched its “Pay-by-Mail” Sales tax collection program to eliminate “deadline payments”. It took this step to reduce collections and ensure that a taxpayer knows they have to make a payment for a tax that was due when they submitted it. The Arizona Department of Revenue has also adopted the ElectronicFiling system to allow taxpayers to electronically file most Arizona Sales Tax returns and payments, and it has established the first “pay-by-phone” service for Arizona sales tax collection. These changes are intended to increase compliance with sales tax laws and give Arizona taxpayers the peace of mind they should know they won't be held responsible for payment after the date that the tax is due. Form 8752 is for all of these purposes. It provides Arizona residents the ability to quickly report and receive the information necessary for Arizona Department of Revenue to quickly locate and collect tax. Form 8752 also offers tax advice to consumers and businesses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 for Gilbert Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 for Gilbert Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 for Gilbert Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 for Gilbert Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.