Award-winning PDF software

Form 8752 for Raleigh North Carolina: What You Should Know

The form provides information necessary for processing your application. The Dry-cleaning solvent tax is assessed on persons who receive and use commercial grade chemicals by means of an automatic dispenser, pump, hose or other appliance as part of their dry cleaning business. The tax is imposed under a sales and use tax statute that also is imposed on those who receive and use dry-cleaning equipment used in the manufacturing of clothing. As required pursuant to the state's sales and use tax statute, all persons required to collect and remit the tax must complete and sign Form NC-DCSR. As a first step in compliance, owners of retail establishments must register with the department. Form NC-DCSR must be filed with the Department of Revenue within sixty days after the date the person began using any dry-cleaning solvent. The taxpayer must also pay any amount due from persons whose name appears on their registration with the department within thirty days after the date the person began using the solvent. Failure to submit this form can result in the imposition of civil and criminal penalties, and additional tax assessments as determined by the Tax Administrator. Form NC-DCSR for North Carolina General Services Department The North Carolina State Department of General Revenue administers the Dry Cleaning Solvent Tax and collects, administers, and remits the revenue collected. General Services takes the responsibility for enforcing collection laws and filing the required amounts of Form NC-DCSR required for filing of Form 8802 information return. North Carolina General Services Department does not have any form for Dry Cleaning Solvent Tax. Form 8802 Information Return If you are required to collect and remit the tax, the North Carolina State Department of General Revenue takes the responsibility to get you the form to submit when you are required to collect and remit the tax. If you are required to file the information return it can be prepared by the taxpayer through NODES or through the Department. You may download or prepare the return yourself. The taxpayer is responsible for the information return that is filed, including, but not limited to, the tax paid on the sale or distribution of chemicals, the amount of sales and use tax paid, and the amount of tax assessed. The form shall be completed within 90 days from the time of the transaction at which the sales or use tax was collected. The information return should show the sales of the chemicals and should summarize the total amount of the sale and amount of the tax assessed.

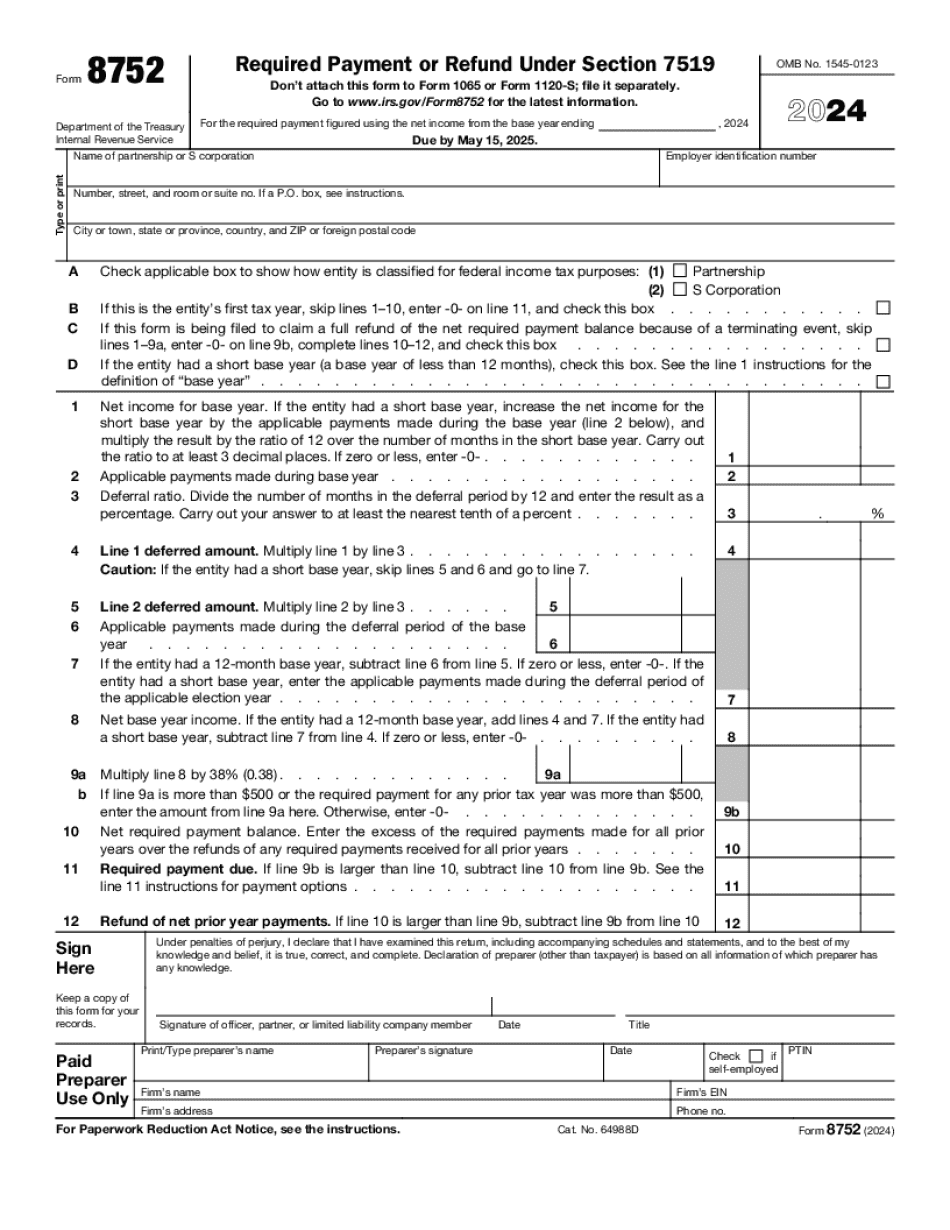

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 for Raleigh North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 for Raleigh North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 for Raleigh North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 for Raleigh North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.