Award-winning PDF software

Form 8752 online Clarksville Tennessee: What You Should Know

Section 7(b) and Section 7(e) of Title 15, Code of Federal Regulations. “The court held that South Dakota had adopted state law pre-empting interstate sales taxes and pre-empting its constitution, and that to avoid such a result, Wayfair must collect sales taxes from South Dakota customers and pass on the tax to its customers.” Tennessee Department of Revenue — internet Sales Tax FAQ Statewide Information. — Tennessee Sales Tax South Dakota v Wayfair. Wayfair, the largest online seller of consumer electronics in the United States, brought to court against the State of South Dakota for an act of state government that has prevented it from collecting sales tax from online buyers in other states. In the case, South Dakota argued that it has the authority to collect state sales taxes on foreign-sourced goods sold through the state's online sales tax system, and that it does not violate the U.S. Constitution by collecting a tax on those sales.[1] The district court had previously heard argument in the case during the first half of 2016, and entered a permanent injunction against the state, ordering that the state's sales tax system be dismantled. South Dakota also requested a permanent injunction against Wayfair, and the district court granted both injunctions on February 9, 2017.”[2] On April 6, 2017, the South Dakota Supreme Court issued a decision, vacating Wayfair's permanent injunction and remanding for the district court to determine whether the State of South Dakota may still enforce its sales tax collection statute. On May 2, 2017, the Supreme Court issued a decision, reinstating Wayfair's permanent injunction, ruling that the district court has jurisdiction to enforce its sales tax collection statute.[3] The court declined to consider whether the State has the authority to collect North/South interstate sales taxes. In its order, the court said, “It is proper to allow Wayfair a chance to prove that its actions are not pre-empted by any federal or state law, but we decline to extend its authority beyond what it has claimed.” On March 26, 2018, the district court again issued an order vacating Wayfair's permanent injunction and remanding the case for further proceedings.

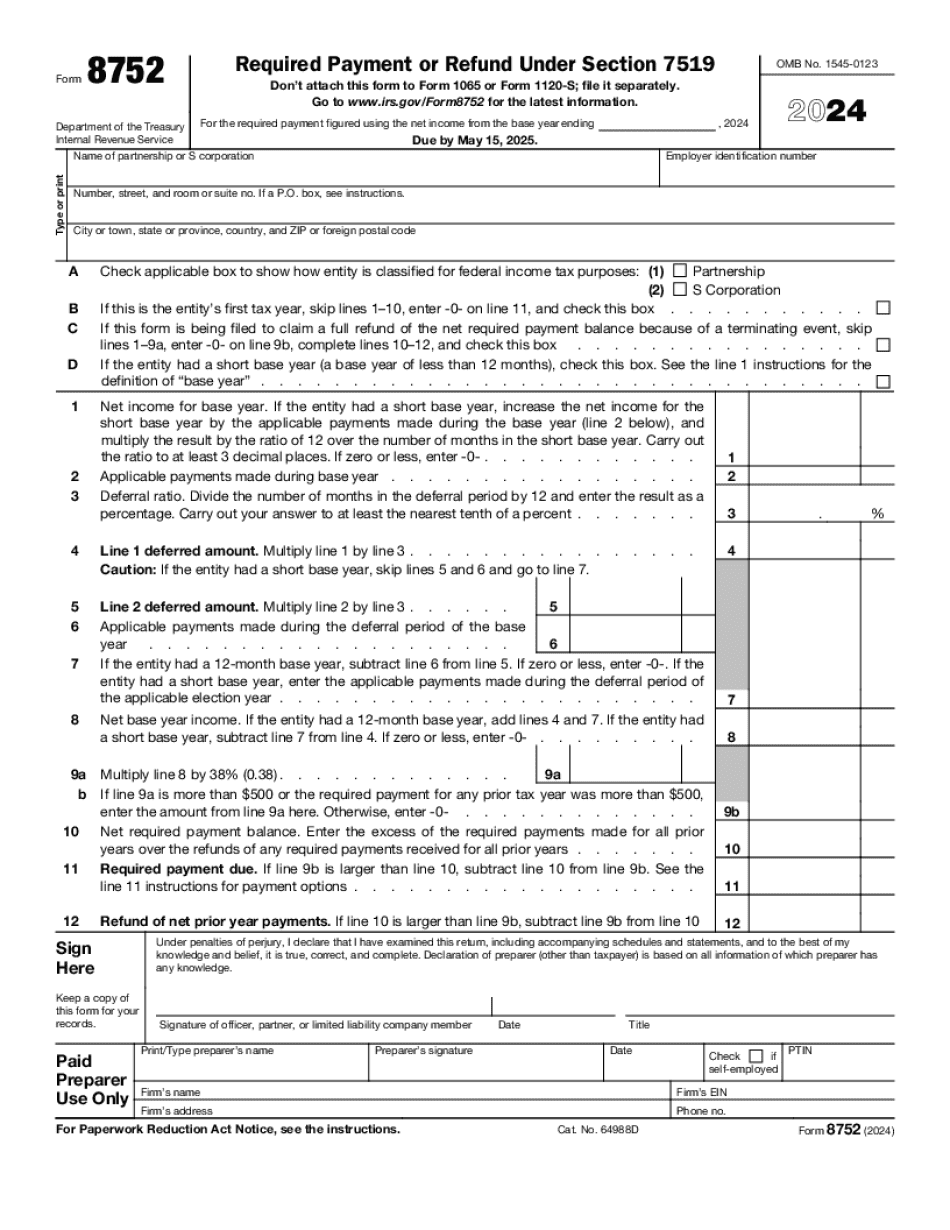

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 online Clarksville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 online Clarksville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 online Clarksville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 online Clarksville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.