Award-winning PDF software

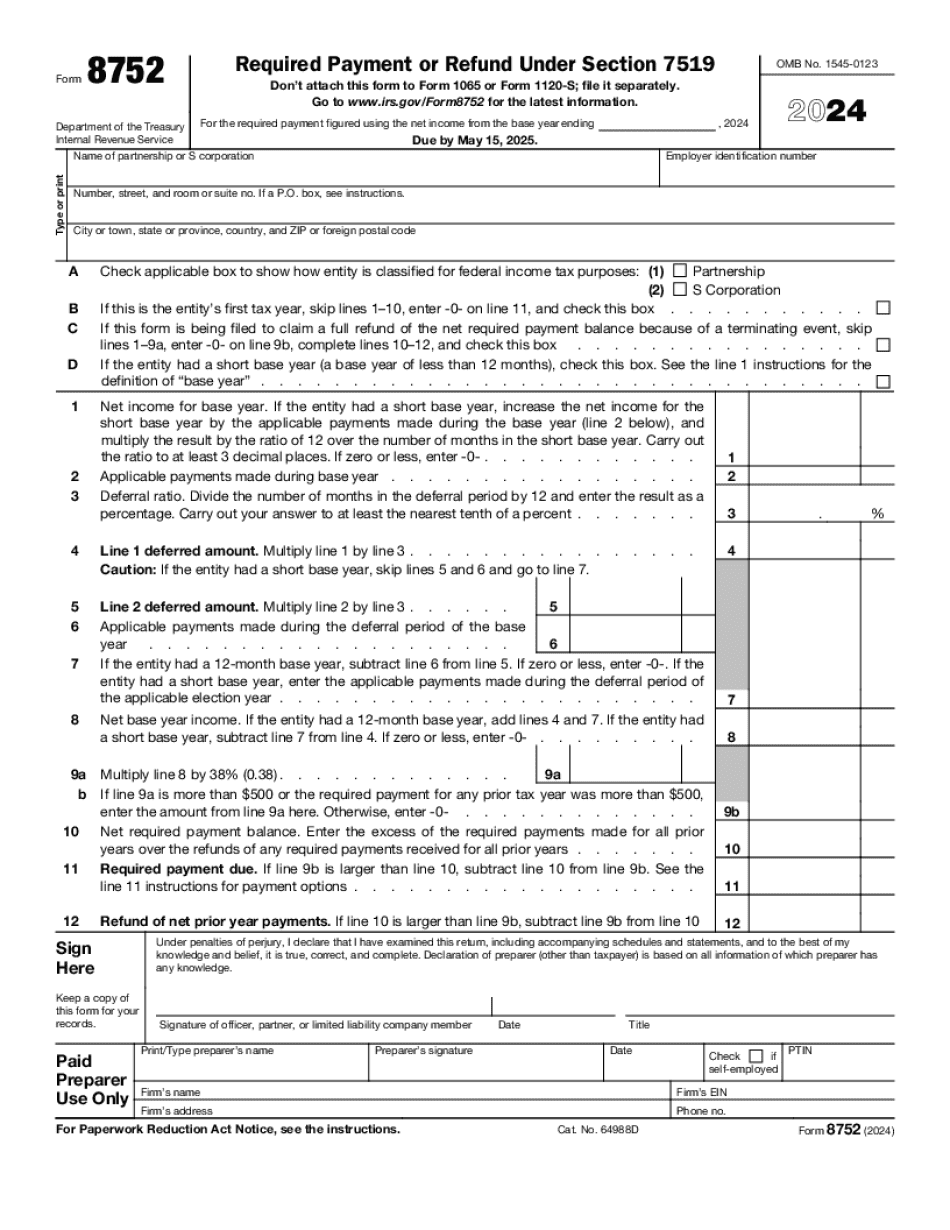

Form 8752 online Grand Prairie Texas: What You Should Know

This course is offered once every quarter. CERTIFIED NATIONAL REPAIR SERVICES BARRETT & THORPE, P.A. BARRETT & THORPE, P.A. SCHULTZ, A & A D.N.C. BARRETT & THORPE, P.A. (PARKING LOT, LOWER EAST SIDE) PARCEL 5 – 1529, ST-CROIX, FL-33415. BARRETT & THORPE has been providing quality professional repairs and alterations since 1971. We specialize in fixing damaged areas. BARRETT & THORPE has been in business for over 40 years and is one of the largest providers of residential and commercial repairs in the Tampa Bay area. Forms and Documents Required to Be Filed with your State (including FL) In addition to registering your company, you must file certain forms and documents with your state. Below are some specific forms and documentation that you may be required to file. This is a general overview of how to file for a business tax exemption or a Form 2555. This article does not cover the requirements for form 2555, the form to attach to your state return if your business is exempt. These articles are provided as general guidelines and to help you be prepared with your documents. The specific forms/documents you will use may vary depending on your situation. Form 2555 — U.S. Individual Income Tax Return Form 2555 is used to provide an individual with an exemption or a report on income tax owed. To file a Form 2555, you will need to provide: Your Social Security Number (SSN) A completed and signed Form 2555-EZ, Individual Income Tax Return (Form 2555) An acceptable identification document (A driver's license, passport, etc.) You must file the Form 2555 within 3 months of the due date of the income tax return. A separate Form 2555 is required for federal tax reporting. If you are self-employed and file Form 8802, You will receive a Form 8758 for the form 2555 (1040). The Form 8758 must be received by the IRS by the due date of the Form 2555 (1040) as applicable.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 online Grand Prairie Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 online Grand Prairie Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 online Grand Prairie Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 online Grand Prairie Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.