Award-winning PDF software

Form 8752 online Naperville Illinois: What You Should Know

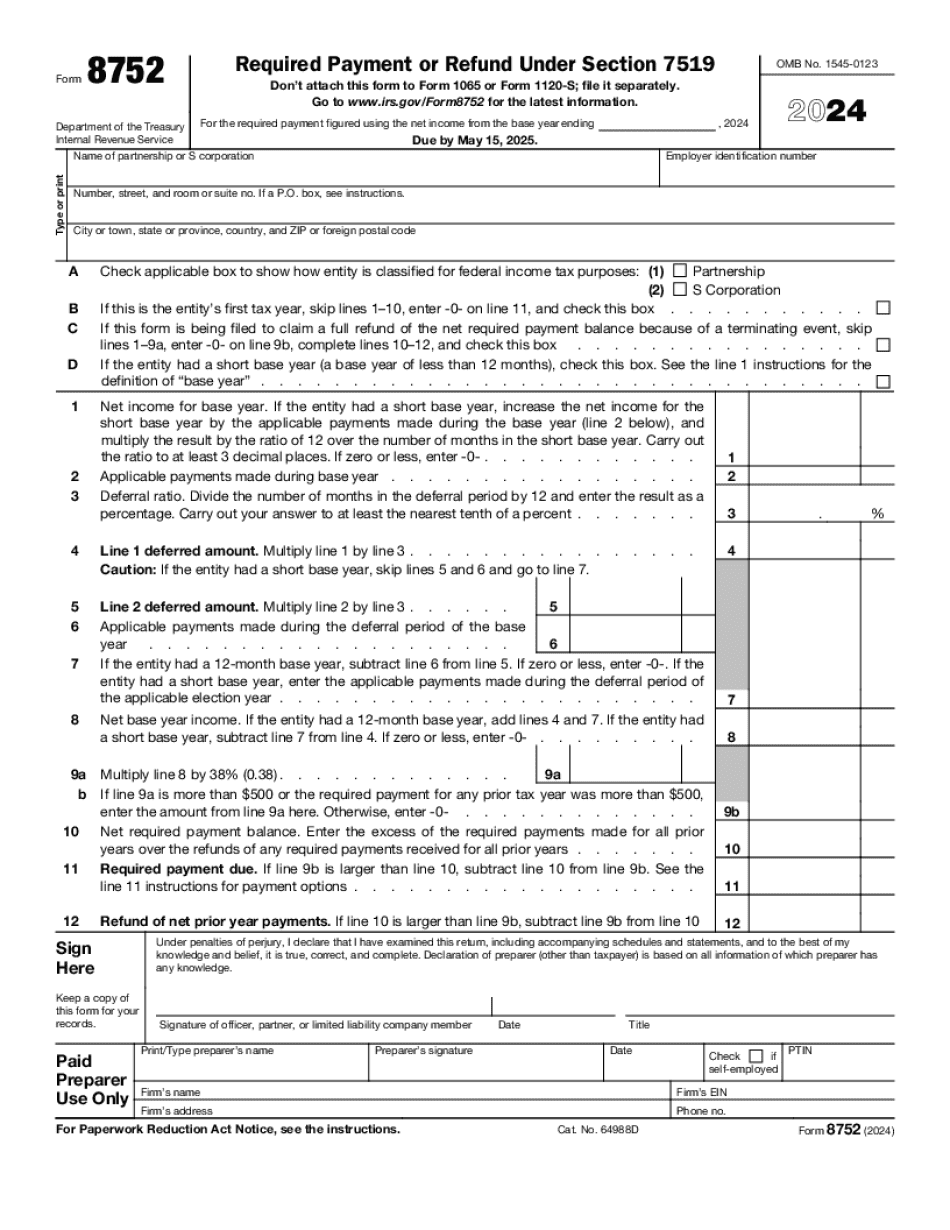

Form 8752: Required Payment or Refund Under Section 7519 (2017) How to Find Your Form If you'd like to find out whether your current entity is listed as a “qualified employer and a qualifying person” (REP) under section 409A of the Internal Revenue Code (IRC), then you'll be using Form 990-EZ(B) to obtain your tax return. You'll get the full Form 990-EZ(B) form if your current entity is a qualified employer and a qualifying person in one of these 5 categories: The business meets the criteria for “qualified employer and a REP” for: a member or owner of an LLC and a member of an S corporation a member or owner of an LLC and a partnership a member or owner of a corporation organized under the laws of the federal government and a member of a corporation organized under such laws and is not a corporation taxable under IRC Section 4960 See the IRS Form 990-EZ(B) link and the table below for a complete listing of the criteria that must be met before a business can be a “REP” based on its owners being or would ordinarily be considered a REP. If your current entity is not listed as a “qualified employer and a qualifying person,” then it likely is not a REP as the business does not meet any of the requirements above. REP Business: An entity meets any of the criteria for REP listed above. The income is allocated to the employees who worked for the entity in a calendar year. The value of the income is allocable to each employee reasonably as an itemized deduction on the entity's income tax return. Other income (income received through investments or by gift or inheritance) is not allocated. The income is subject to withholding tax on which the entity would generally be liable during the following taxable year. All qualified contributions made to the entity during the taxable year by an employee of the entity are required to be included in gross income as wages subject to the same rules and tax as wages paid by the employer under IRC Section 1204. REP Non-Employee Director or Employee: An entity meets all the criteria for REP listed above. None of the qualified contributions to the entity during the taxable year by an employee of the entity are required to be included in gross income as wages subject to the same rules and tax as wages paid by the employer under IRC Section 1204.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8752 online Naperville Illinois, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8752 online Naperville Illinois?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8752 online Naperville Illinois aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8752 online Naperville Illinois from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.