Award-winning PDF software

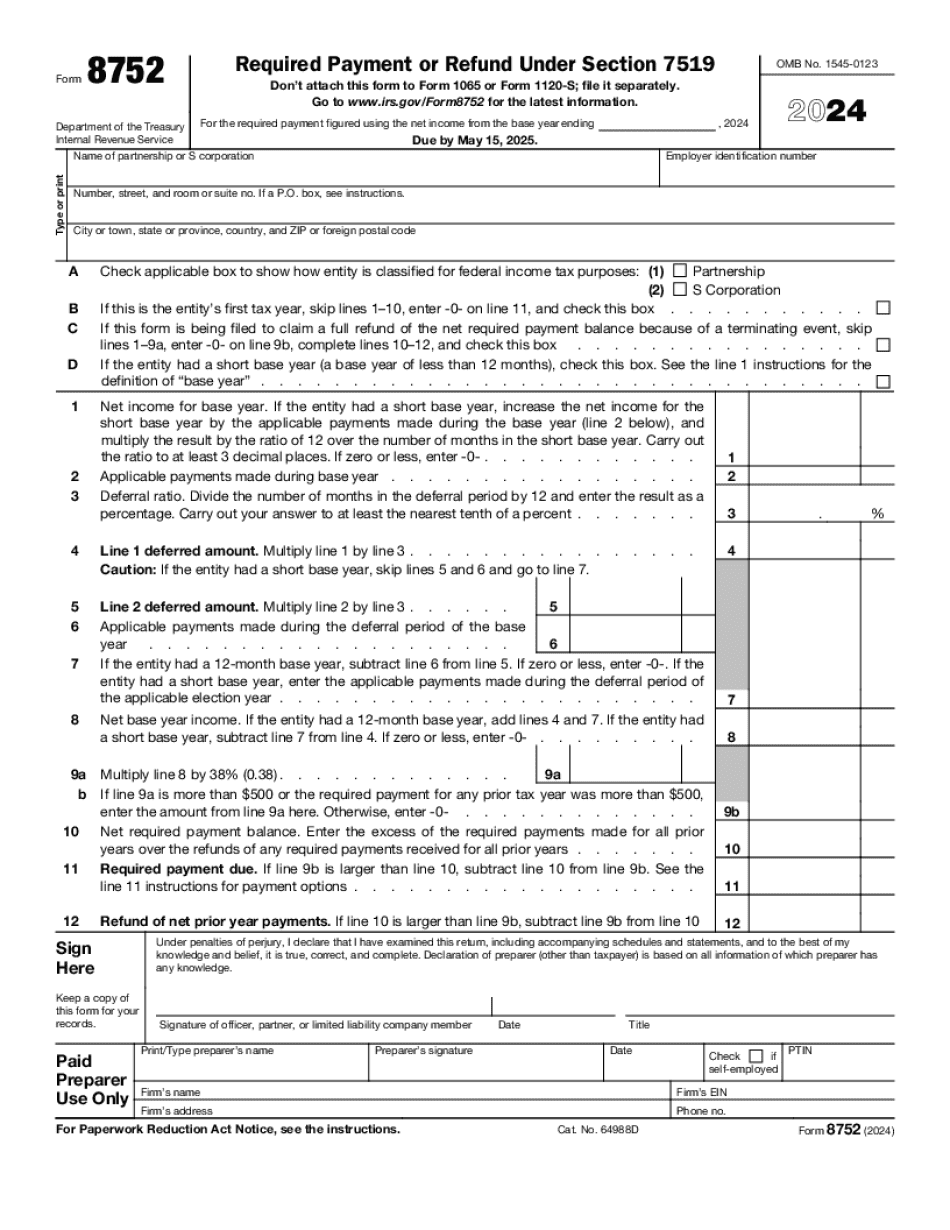

North Las Vegas Nevada Form 8752: What You Should Know

Full bath on lower level ~ 2nd shower room on lower level ~ 4 fully equipped closets, with high speed washer and dryer. Lots of windows for indoor and outdoors viewing ! ~ Fully equipped kitchen with dishwasher, microwave, and all other kitchen appliances. ~ Master bedroom with separate bath ~ 3 stories master bath with a waterfall. ~ Large second full bath that connects to 3 full baths and 2 smaller baths. ~ Spacious walk-in closet with lots of windows for indoor and outdoors viewing ! ~ Fully equipped laundry center with dryer ~ Beautiful hardwood floors throughout ~ Large master bath with high ceilings and great views ~ HUGE kitchen with a full range stove, fridge, and refrigerator. ~ Full bathtub is in the master bedroom and connected to 3 separate water closets, large enough for two large towels. ~ Large walk-in closet with a full wardrobe. ~ Double sinks in each of 4 separate spaces. ~ 4 full bath tubs. ~ Large vanity, bath rod, shower curtain, and mirror with custom stone work by the pool builder ! 5,995,000 + 2,995,000 + 0 + The IRS asks Fiscal Year, S Corporation s, and Partnership s to file Form 8752. The IRS then holds in an escrow-like account an estimate of you would be required to pay under section 7519. What's The Big Deal? If you're a partnership or corporation, you just need to report your quarterly tax payments and the tax period (monthly payment period) to calculate your monthly gross income. But if you're a single person, you had to file either a Schedule C (for partnerships) or Schedule SE (for corporations) instead. If you're a single person, and you haven't filed anything, you owe the IRS taxes owed at least annually. What's the big deal about this “required payment” form? If you don't file a Schedule C (for partnerships or Schedule SE) before the due date of the most recent quarter (month) at an IRS office, they hold on to your quarterly payments and your required payment becomes your gross income in future quarters. Your gross income, you can only pay the full tax due if you file a Form 1040.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas Nevada Form 8752, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas Nevada Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas Nevada Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas Nevada Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.