Award-winning PDF software

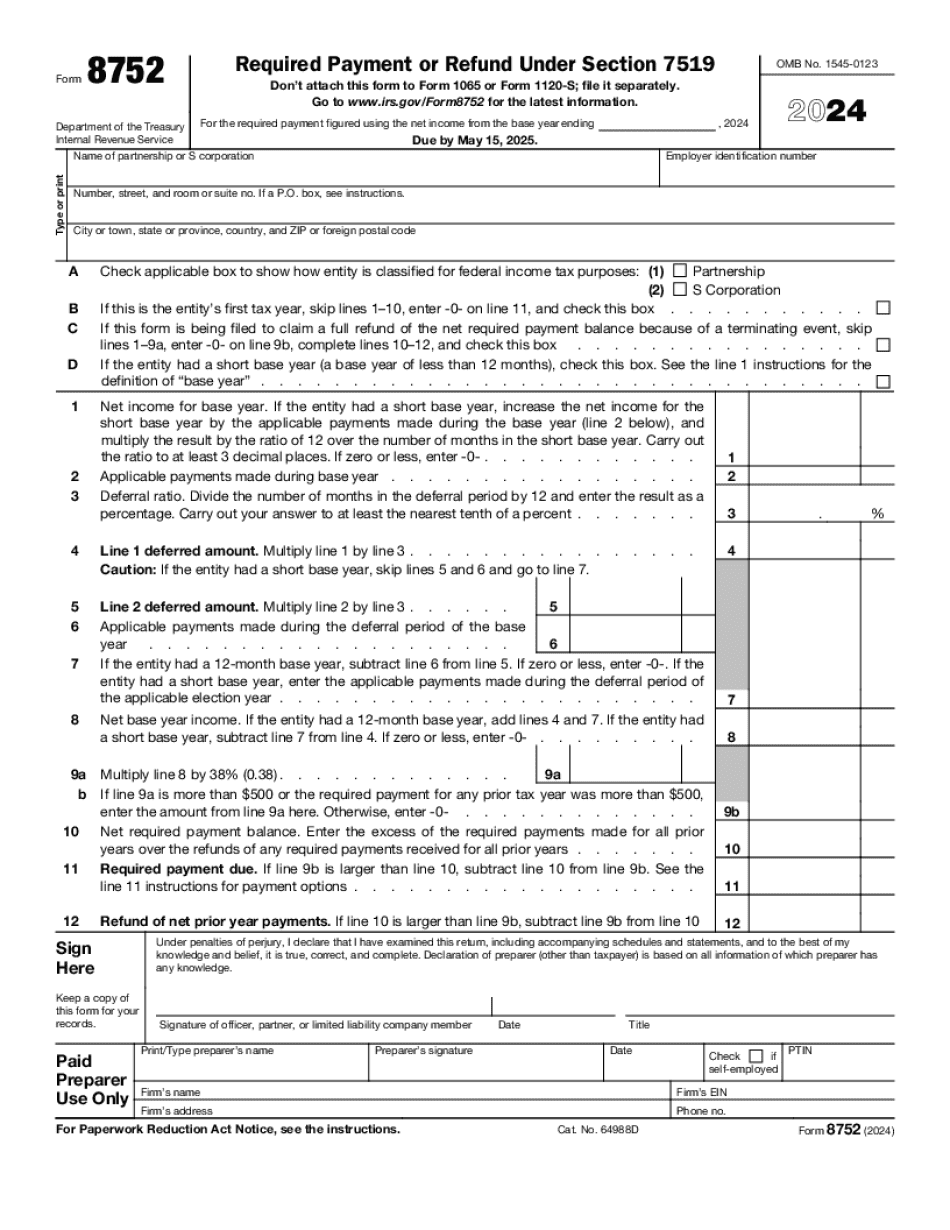

Overland Park Kansas Form 8752: What You Should Know

You can use a form 990 for those charities and non-profits who qualify for the tax-free filing status for a 501C3(c)3 Non-Profit Corporation. This article is about Form 990, Required Payment or Refund Under § 6533(a): Overland Park. A 5 Bed, 2 Bath, 1785-Firm, Duplex, Triplex, Duplex, Apartment, With A Living Area, Located at 755 SW 8TH AVE. NE, Overland Park, KS 66205; Form 990 is required. The amount shown under the box for the “Income from Contracts or Business” line is only required if income from contracting, business or other activities can be measured by income tax. See the article on Non-profit. For more information on Form 8750 (Refund of Tax Overpayment), click here. If your property is not listed in the table, or if we don't have a statement that can help you contact your tax professional, you can use the IRS' interactive chart to help figure your refund. Tax return preparation instructions: You do not have to file Form 8781, a combined return, on the current year tax due date. This date is the return filing deadline. You can use Form 8781 to update any information from the previous year's return, or to figure your refund from last year's return. You can file Form 8781 up to 2 weeks before the return due date if you plan to file your return by electronic filing. The 2-week time frame ends on the following day. On the return due date, add the box to the return for the “Overpayments,” and enter the following information in the amount shown on the following page: Income tax, Social Security and Medicare tax paid on income under 10.00, or under 100,000, excluding the overpayments you have reported on the previous return. Enter the estimated tax due on the next page. To determine your refund, first figure: Your federal refund. The difference between your federal and state refund. Your refund to you. Enter your refund from that same return. You should apply and pay back the excess tax by filing a Form 2555-A, Additional Tax Withholding and Interest for Overpayments, with the IRS within 3 years of the return due.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Overland Park Kansas Form 8752, keep away from glitches and furnish it inside a timely method:

How to complete a Overland Park Kansas Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Overland Park Kansas Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Overland Park Kansas Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.