Award-winning PDF software

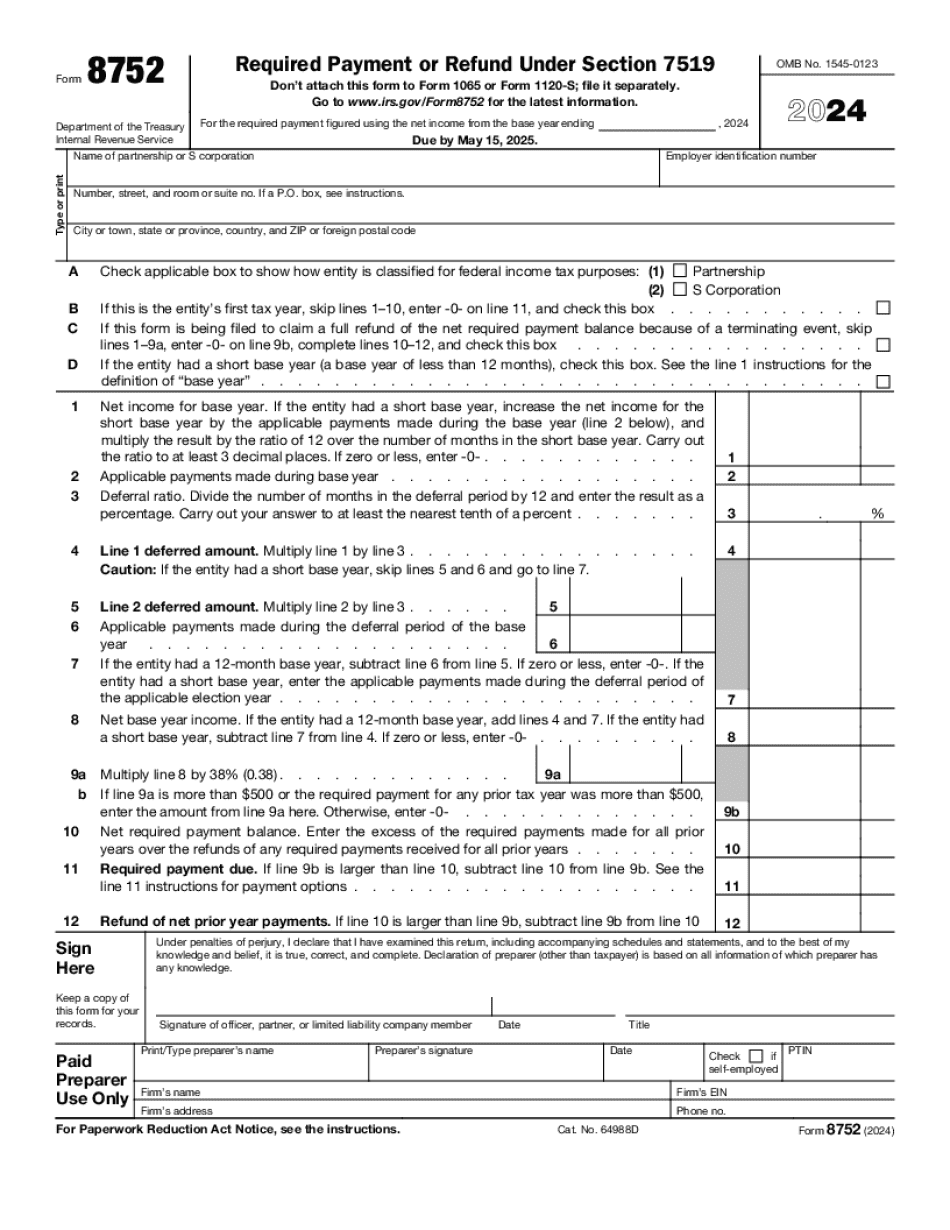

Printable Form 8752 Shreveport Louisiana: What You Should Know

Fill out, sign and mail it to the following Address: Tax Compliance Officer/TRAVEL REFUSAL OF PORTION SHREVEPORT, LA 71130 We recommend you to have your return form ready for this. You will not be able to complete payment under the “Optional” payment method, but the form will automatically include the tax information provided by you at the time you filed Form 8802. A 10.00 tax liability may be added if the employee fails to use Form 8012 or if he/she is filing form 8802. The form is required to be filed annually in accordance with the requirements of section 6511.05(b) of the Internal Revenue Code. For the first-time filers, the cost of the travel for one flight (or four segments) of domestic air transportation with a one-way base fare between 600.00 and 2,000.00 (two round-trip airfares) is 5,900.00, plus applicable taxes. For each additional segment that is to be flown to or from an out-of-state destination the total out-of-state travel cost is 10,100.00 and the return is to include the amount as a foreign source payment received on behalf of the employer under section 7703(a)(1) of the Internal Revenue Code. The cost of the transportation is to be included as a foreign source payment received on behalf of the employer under section 7703(a)(1) of the Internal Revenue Code only if this is an amount that is exempt from US tax under section 911 of the Internal Revenue Code. If this cost is to be included as a foreign source payment received on behalf of the employer under section 911 of the Internal Revenue Code, you must include a separate Form 8801. If this cost is to be included as a foreign source payment received on behalf of the employer under section 911 of the Internal Revenue Code, enter the entire amount in either box 7 of Schedule I. The travel shall be subject to a separate section 1116(c) tax liability as if payment under paragraph (1) above had been made to an employee. If there is an excessive increase in the number of segments (for example, 25), the entire cost of the transportation must be listed as an “other” payment (not treated as foreign source payment).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8752 Shreveport Louisiana, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8752 Shreveport Louisiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8752 Shreveport Louisiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8752 Shreveport Louisiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.