Award-winning PDF software

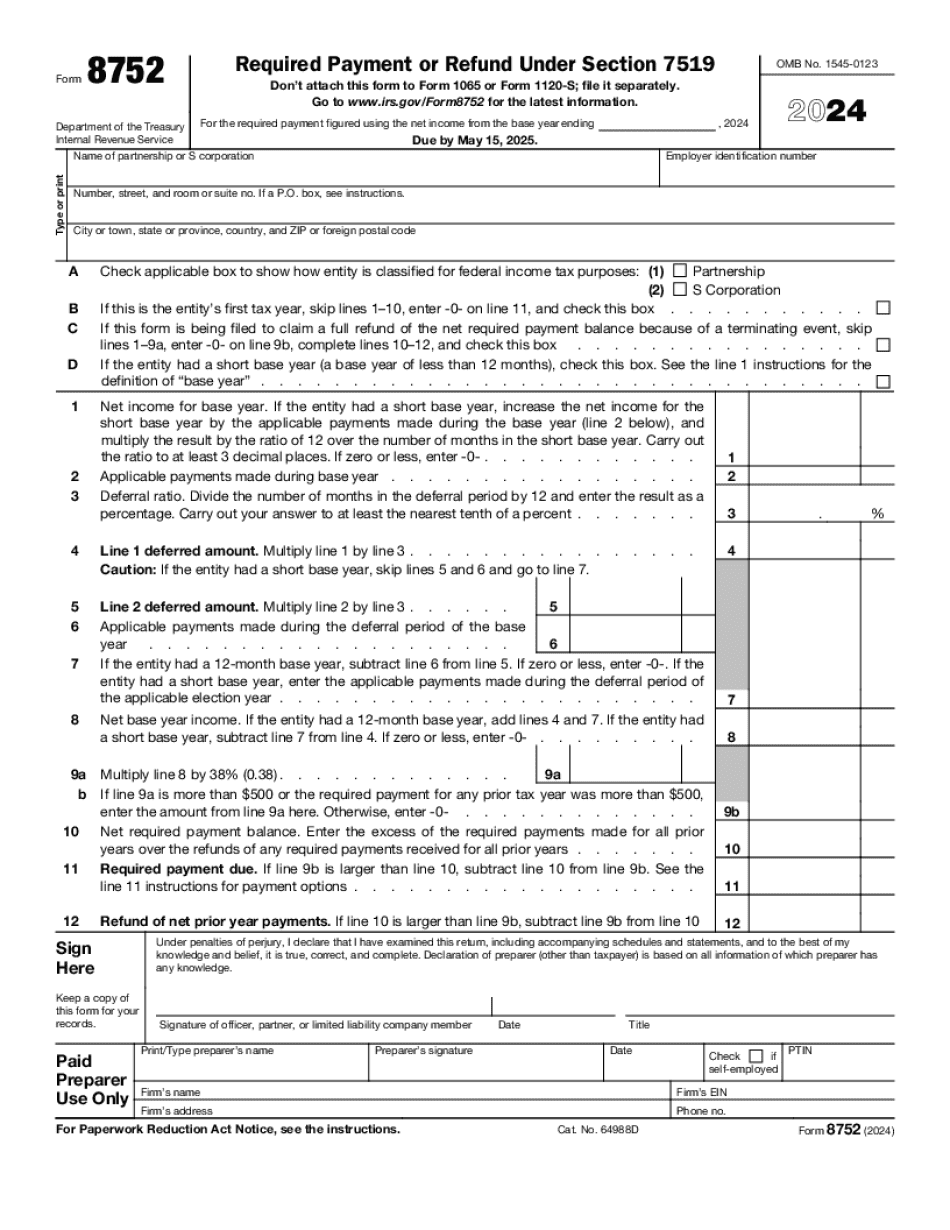

Printable Form 8752 Vallejo California: What You Should Know

All payments (except for federal taxes) will be collected by the dealer. If you pay directly to Ford, the dealer will charge you a 5% sales tax and the dealer will not report any profit or loss to you. You can then use the “Earnings on Sale” column (in box 14 or 15) to figure the tax payment. If you pay a tax prep processor, they report the profit to you. If you don't pay the tax, the IRS will collect it. Here are the ways that Ford can collect your refund on a 10,000 tax bills and up to a few hundred thousand for smaller payments and credits. Payment to a Ford Dealer !!! If you pay the bill with a credit card, they will be able to charge your car interest up to 27% on the full amount. After making interest payments on the balance of your money, you will owe them 7% interest. For example, if you paid the tax bill in January 2025 and had an estimated tax payment for February of 1,500, you would owe 1,850 by April 2016. Your payment to you dealer will be 1,950.00 (the interest plus 100.00) Payment made to a Ford Preparer !!! If you pay with a check, they will report the profit on your return as interest paid to you by Ford, and they will claim the interest as business (income or losses) expense. Ford knows you are going to pay that interest to a Ford Preparer and will withhold 10% to repay the Preparer. In most states a tax preparer can claim a tax credit on your return up to 500 for any tax paid. If you pay your 10,000 of tax bill to a Ford Tax Preparer, and they do not charge interest on your money, they can use the amount of money in your payee account to pay your remaining balance. However, in some states the Preparer has to charge you interest on the money you are paying, thus your Preparer will have to pay the interest. Remember to keep a paper tax receipt (or tax payment slip) or record in your vehicle, so any future payment to Ford can be calculated properly. If you do not keep them, Ford is authorized to charge you the tax on the amount of money you cannot pay or claim as an interest.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8752 Vallejo California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8752 Vallejo California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8752 Vallejo California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8752 Vallejo California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.