Award-winning PDF software

Thousand Oaks California online Form 8752: What You Should Know

This week the IRS has finally released Section 852-10, and it is very interesting, and it has caused quite a backlash, with many people not happy with what they know. In short, they have said that the “net prior year income” may be the amount that is taken for each student. Is the net prior year income the amount I could make under “guaranteed income” under Section 940, or is it the amount for the entire year, or maybe only this school year? It's all in the definition, where it starts and ends, so it's not as clear-cut. It really depends on if you think it is the entire previous year, or just part of the year. You'll have to ask around, it's on the IRS website too if you are looking for more information. You may be able to take a loan based on certain Section 852-10 (NON-GUARANTEED INCOME) payments. Some people are very upset about this, and think of it as taking away 5000 from their paychecks. If they are not making such payments, then are they taking the “minimum allowable amount” of that year? If you didn't have any NONE payments, or even some payments, then are you also taking the “minimum allowable amount”? Well, it will all depend on how strict the IRS is. It's going to depend on your personal situation. If you make 1000 a month, 1000 is the maximum income that you can have before any loan payments can start in a year. So if your total NONE amounts are 2500, then you can make 2025 and be able to pay back the loan before the end of the year. So let's say you have 2500 and all of your loans are 6000. You could still make 2000, and you won't be in trouble. But if yours are 10000 a month with no NONE payments, you need to start making payments the next month. Remember that this is the “net prior year income” amount that you would be making in each Pay period as a new person, not taking in any of your current salary or pension. Let me get this straight, the IRS said they will not give more than 5000 off the top of the monthly checks to people whose income is 2025 or less in a given year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Thousand Oaks California online Form 8752, keep away from glitches and furnish it inside a timely method:

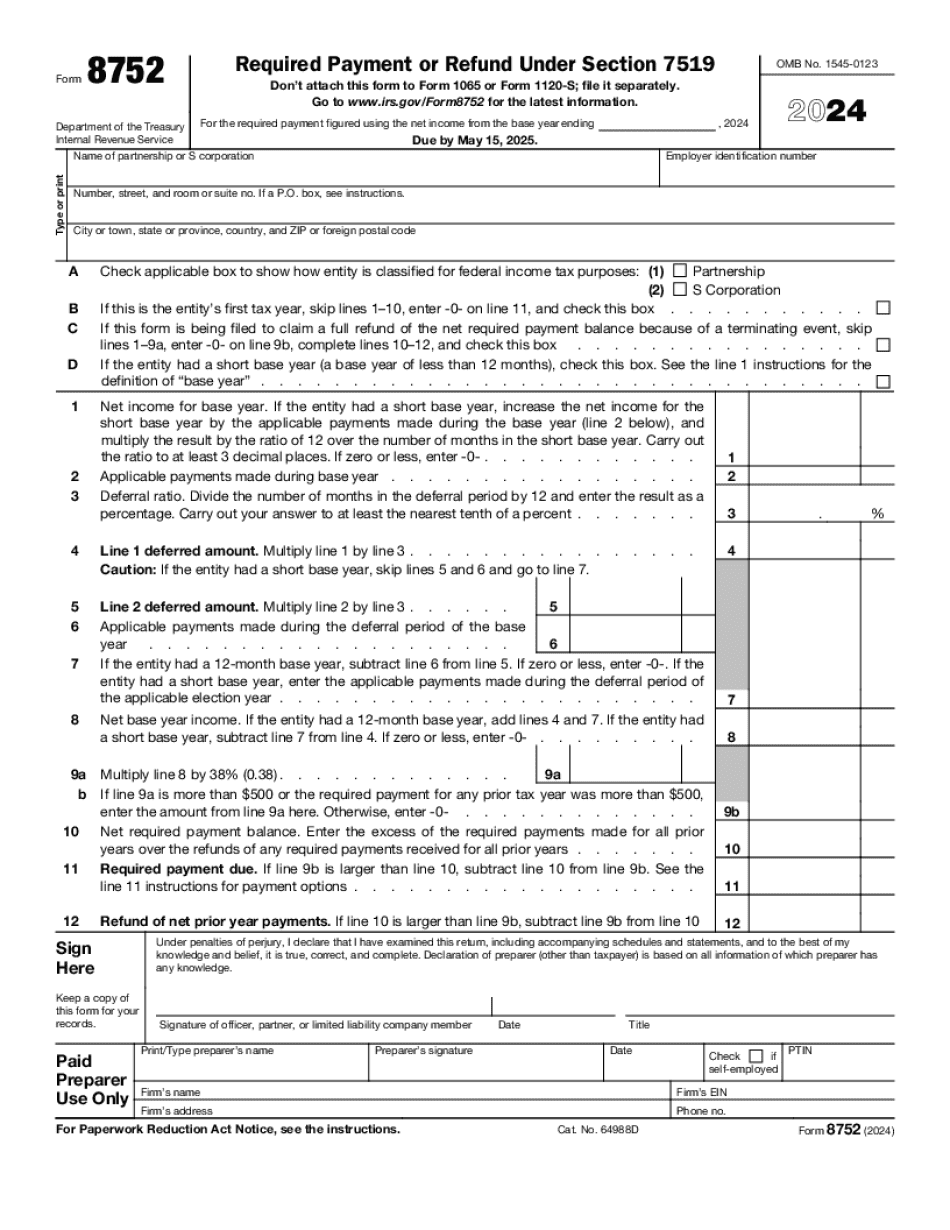

How to complete a Thousand Oaks California online Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Thousand Oaks California online Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Thousand Oaks California online Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.