Award-winning PDF software

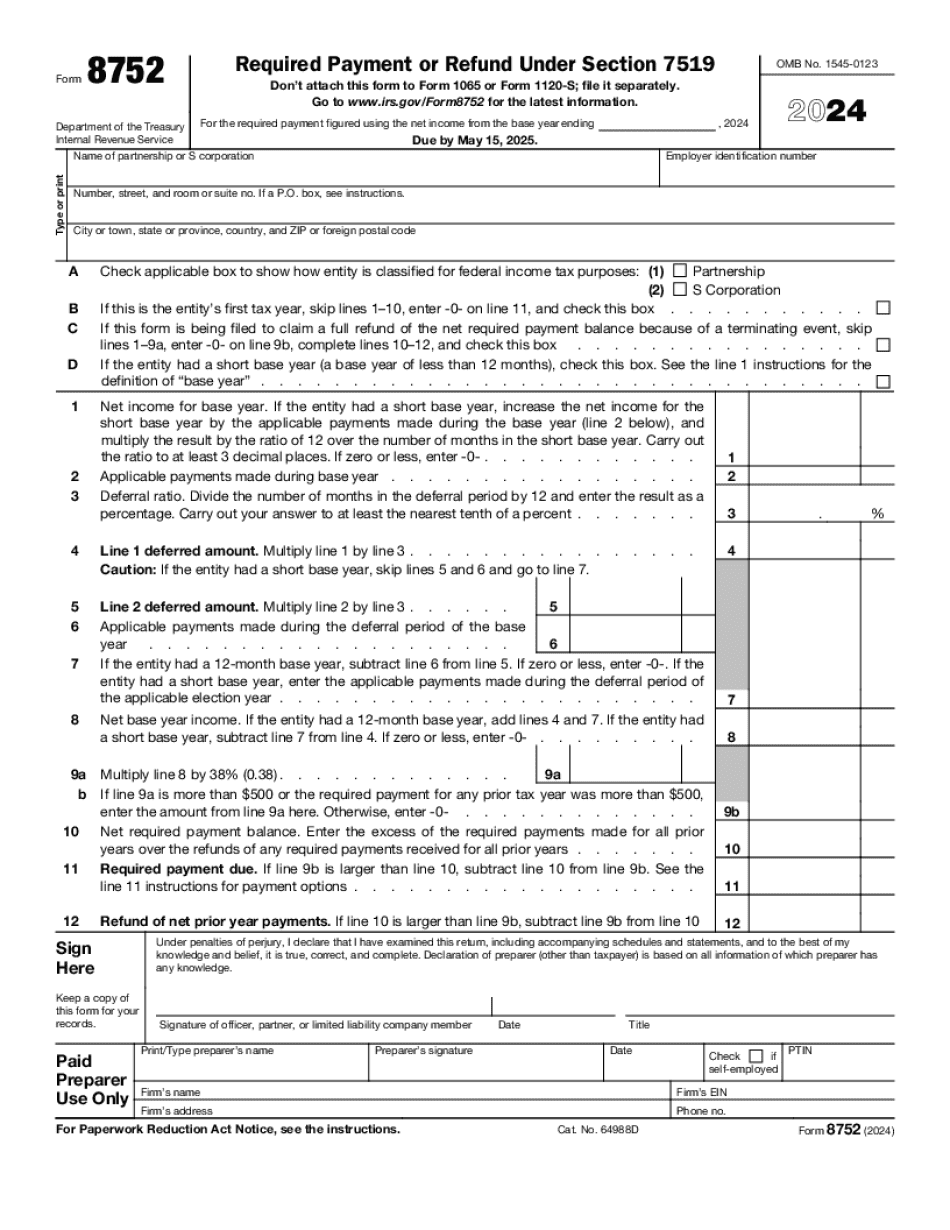

Printable Form 8752 Allegheny Pennsylvania: What You Should Know

If you're unsure of your income and the amount of tax you owe, you're encouraged to use the Form 8802, Individual Income Tax Return. If you still have questions on this guide, contact our office. For additional tax information, please see the Pennsylvania Department of Revenue's website. PA TAXES PA STATE REVENUE TAX ACT Chapter 7, Section 2 — Business Income Tax Effective January 1, 2019, the state of Pennsylvania and its officials, agents, employees and representatives shall do one or more of the following: • Impose one or more of the additional personal income tax rates as provided in section 2a of chapter 7 or a rate of corporate or real property tax based on a percentage of assessed value for a purpose which may not be the same as the primary purpose for which the rate was imposed on a taxpayer for the previous tax year. • Impose the same tax as was, as of January 1, 1991, imposed for a business (other than a professional or agricultural business enterprise) under section 6103 of the Internal Revenue Code of 1986, except that the tax is not subject to the limitations contained in section 6103(a) and (b) of that Act. • Provide for an optional tax rate of one-half of the minimum rate otherwise provided in this section, provided that the tax is not less than one-half of the minimum rate otherwise provided. • Establish a system for electronic filing of all tax returns and reports. • Implement procedures to permit the collection of the Pennsylvania State sales tax and transfer taxes imposed under this Act and that include: · A rate of 7% for business owners; · A transfer tax rate of 0; · A rate of 30% for any business having taxable sales of less than 5 million; · A tax rate of 55% for any business having taxable sales of greater than 5 million and that does not file an annual tax return; · A return deadline for an owner who fails to file a return on time. Effective January 1, 2015, the state of Pennsylvania shall do one or more of the following: • Implement any one-half or multiple tax provision in section 13 of chapter 7 without increasing the rate. • Impose a tax system that requires a business to use a method of reporting and collecting taxes which is different from the method of reporting and collecting taxes which the state's tax administrators currently use.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8752 Allegheny Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8752 Allegheny Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8752 Allegheny Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8752 Allegheny Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.