Award-winning PDF software

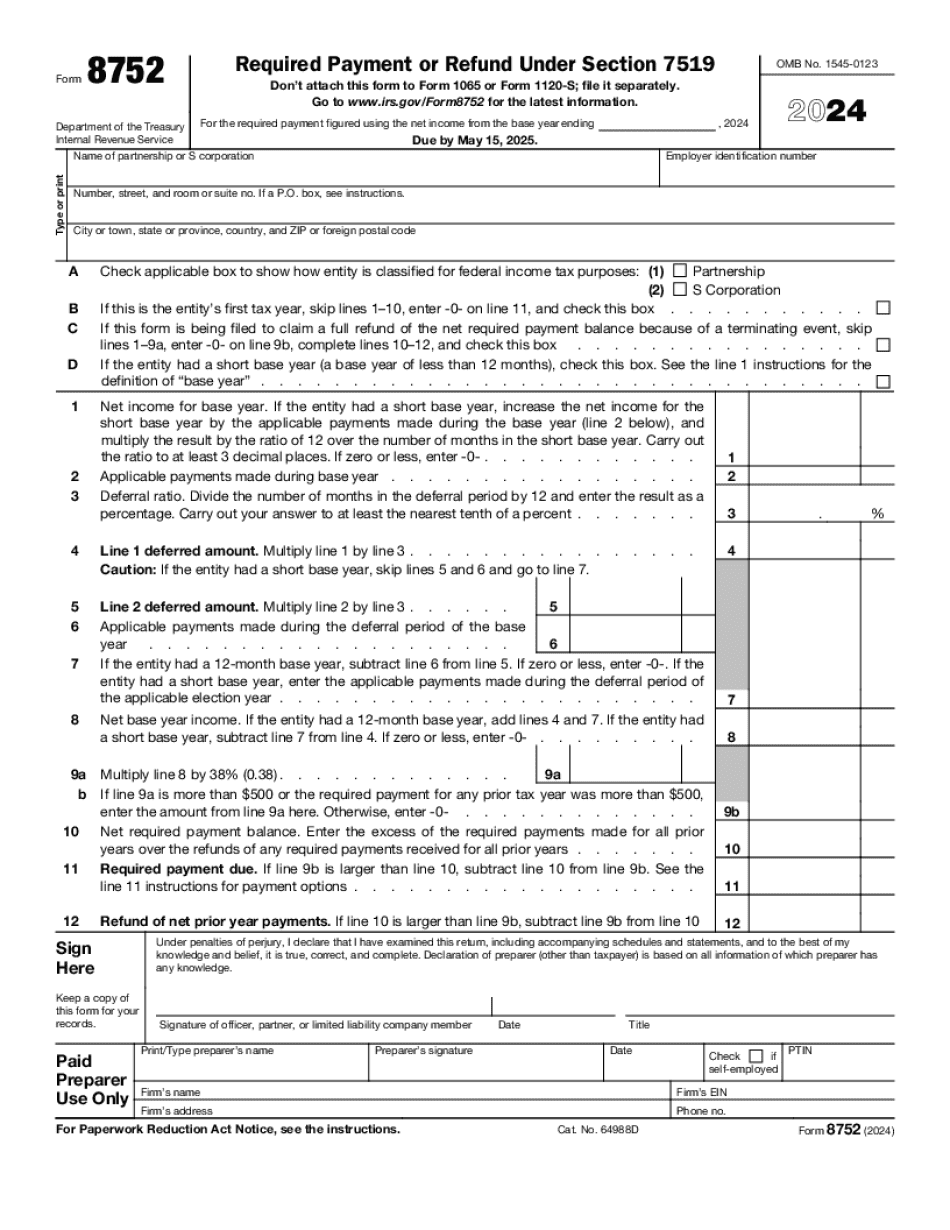

Wichita Kansas Form 8752: What You Should Know

For the purposes of Kansas state law, your training information program is a training program. B. The training information program must contain adequate information related to the state's business tax liability law (KC A. S.A. 74-32,418). C. In the absence of a tax credit, the tax liability imposed on a partnership, S corporation, or sole proprietorship is the average of the applicable tax obligations for the following tax year plus a maximum of 100 per partnership, 50 per corporation, and 25 per sole proprietor. The Kansas General Assembly has authorized the Department of Revenue to charge an additional fee for the issuance and/or maintenance of the training program, 250 for an establishment that meets both of two conditions (1) the training must be done during or within the course of your employment and (2) no other tax liability exists. The Kansas Office of Revenue (KOR) will establish eligibility criteria through its tax liability determinations in consultation with KOR/KOR-IRS. The training program must meet both of the requirements in 74.32,418, which requires that both the average training expense per partner and the total costs (including all amounts that are not tax due, including an excise tax in the amount of one thousand five hundred dollars and any amount that could have been incurred, but for no tax liability) (see 74-32,418(a)) are not less than 100. A. An organization to which the Department of Revenue has a grant from the Kansas State Foundation in order to provide training for the tax community in Kansas, including but not limited to, Kansas tax attorneys, tax professionals, tax practitioners with tax law expertise and educational organizations and their attendees, and K-12 educational agencies, may be exempt from the training requirement in 74-32,418 if the training program is conducted by a partnership, corporation, or sole proprietorship that: (1) Is formed, owned, or managed by a Kansas resident; (2) Holds a Kansas nonresident member and does not receive its nonresident member's investment income from any other sources without the prior written approval of the nonresident member; and (3) Possesses no more than 10 partner(s).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form 8752, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form 8752?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form 8752 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form 8752 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.